Citibank Credit Card Payment Address: A Complete Guide

Paying your Citibank credit card bill on time is crucial for maintaining a good credit score and avoiding late payment fees. But knowing where to send your payment can sometimes be confusing. This comprehensive guide will walk you through all the options available for paying your Citibank credit card, including the various payment addresses you might need, depending on your chosen method.

Understanding Your Citibank Payment Options

Citibank offers a variety of convenient ways to pay your credit card bill, eliminating the need to rely solely on mailing a physical check. This flexibility is designed to fit your busy lifestyle. Here's a breakdown of your options:

-

Online Banking: This is often the fastest and most convenient method. Log into your Citibank online account, navigate to your credit card account, and make a payment directly from your linked bank account or using a debit card. No address is needed for online payments.

-

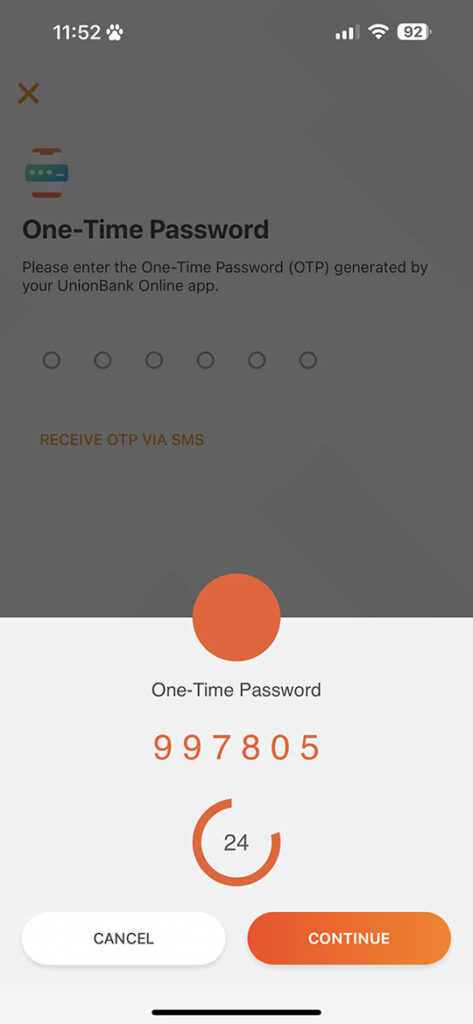

Citi Mobile App: Similar to online banking, the Citi Mobile app provides a quick and secure way to pay your bill from your smartphone or tablet. No physical address is required.

-

Automated Clearing House (ACH) Payments: If you prefer automated payments, setting up ACH transfers through your bank can ensure your bill is paid on time every month. Contact your bank for details on setting up ACH payments to Citibank. You won't need a specific payment address for this method.

-

Mail: While less common now, you can still pay your Citibank credit card bill by mail. However, it's crucial to use the correct address, as using the wrong one can delay your payment and potentially result in late fees. We'll detail the correct mailing address below.

-

Third-Party Payment Services: Some third-party bill payment services (like those offered by your bank or other financial institutions) may allow you to pay your Citibank credit card. Check with your service provider for specific instructions and if a payment address is needed.

Finding the Correct Mailing Address for Your Citibank Credit Card Payment

While online and mobile payments are strongly encouraged for their speed and efficiency, if you must mail a payment, finding the correct address is critical. Crucially, your payment address might not be the address listed on your statement. The specific address depends on your account and location.

Do NOT use the address on your credit card statement unless it explicitly states it's the payment address.

Instead, refer to the payment coupon enclosed with your statement. This coupon will usually display the correct mailing address for your payment. This address is location-specific, and using an incorrect one will delay your payment processing.

If you've misplaced your statement and payment coupon, you can:

- Contact Citibank Customer Service: Call their customer service number (found on your statement or the Citibank website) and request the correct mailing address for your account.

- Check the Citibank Website: The Citibank website may have a section dedicated to payment information, although this varies by region.

Important Note: Always write your account number clearly on your check or money order to ensure accurate processing.

Avoiding Late Payment Fees: Tips for Timely Payments

- Set up automatic payments: Eliminate the risk of forgetting to pay by setting up automatic payments through online banking or ACH transfers.

- Use calendar reminders: Set reminders on your phone or calendar to pay your bill on time.

- Pay early: Paying a few days before the due date ensures your payment arrives on time even if there's a slight delay in the mail.

- Keep track of your due date: Note the due date on your statement and mark it on your calendar.

Conclusion

Paying your Citibank credit card bill is straightforward when you utilize the available digital methods. However, if mailing a payment is necessary, always verify the correct address using the payment coupon included with your statement or by contacting Citibank customer service. By following these tips, you can avoid late fees and maintain a healthy credit history. Remember to always prioritize timely payments to ensure a positive financial standing.