IRS Austin Submission Processing Center Address: Find Your Local Tax Office

Finding the correct address for your IRS tax document submission can be confusing, especially with the numerous IRS offices and processing centers across the country. This article focuses on the IRS Austin Submission Processing Center, providing you with the correct address and guiding you on how to find your local tax office. We'll also cover frequently asked questions to make navigating the IRS system easier.

Understanding IRS Processing Centers

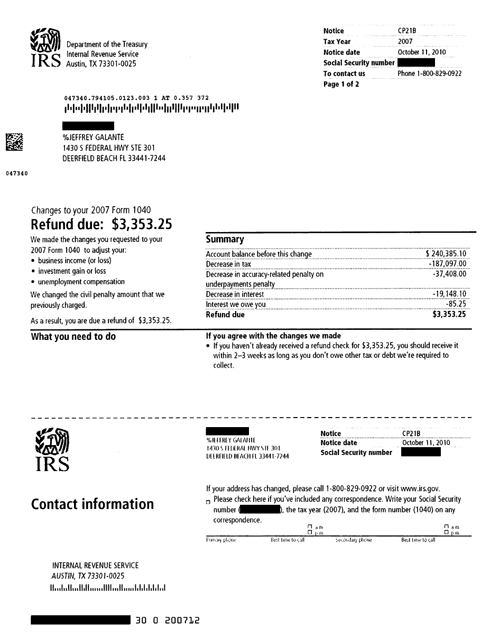

The IRS uses numerous processing centers to handle the massive volume of tax returns and documents it receives each year. These centers are responsible for opening, scanning, and processing tax documents, not for answering taxpayer inquiries. This is crucial to understand – while you might send documents to a processing center, you shouldn't expect immediate responses or assistance with tax issues there.

IRS Austin Submission Processing Center Address:

The address for the Austin Submission Processing Center is:

Internal Revenue Service Austin Submission Processing Center 3651 S IH 35 Frontage Rd Austin, TX 78741

Important Note: Always verify the address on the specific instructions accompanying your tax documents. The IRS sometimes updates addresses or assigns specific processing centers based on the type of document.

Finding Your Local Taxpayer Assistance Center (TAC)

While the Austin processing center handles the processing of your documents, for assistance with your tax situation, you'll need to contact your local Taxpayer Assistance Center (TAC). These centers offer in-person help, phone support, and other resources. Finding your local TAC is simple:

- Use the IRS Locator Tool: The IRS provides a handy online tool to find the nearest TAC. Simply enter your zip code or address on the official IRS website. This is the most accurate and reliable way to locate your local office.

- Check the IRS Website: The IRS website contains a comprehensive list of TACs, searchable by state and city.

- Call the IRS: The IRS national helpline can also help you find the closest TAC to your location.

Frequently Asked Questions (FAQs)

-

What if I sent my documents to the wrong address? Contact the IRS immediately through their helpline or online resources. They'll guide you on how to rectify the situation.

-

How long does it take for the IRS to process my documents? Processing times vary depending on the time of year and the type of document. Check the IRS website for current processing times.

-

Can I track the status of my tax return? Yes, the IRS offers online tools to track your tax return status using your Social Security number and other identifying information.

Why is knowing your local office important?

Knowing where to send your documents and how to access support is crucial for a smooth tax filing experience. Using the incorrect address can lead to delays, while knowing your local TAC allows for quick and effective assistance when you need it.

Call to Action: Use the official IRS website to locate your nearest Taxpayer Assistance Center and ensure you're sending your documents to the correct address to avoid delays. Remember to always verify the address on your specific tax instructions. Don't hesitate to reach out to the IRS directly if you have any questions or concerns.