Understanding Your Deloitte W2 as a Former Employee: A Complete Guide

Leaving Deloitte, a prestigious global firm, marks a significant transition in your career. However, understanding your final pay and tax documentation remains crucial. This comprehensive guide helps former Deloitte employees navigate the intricacies of their W2 form, ensuring a smooth tax filing process.

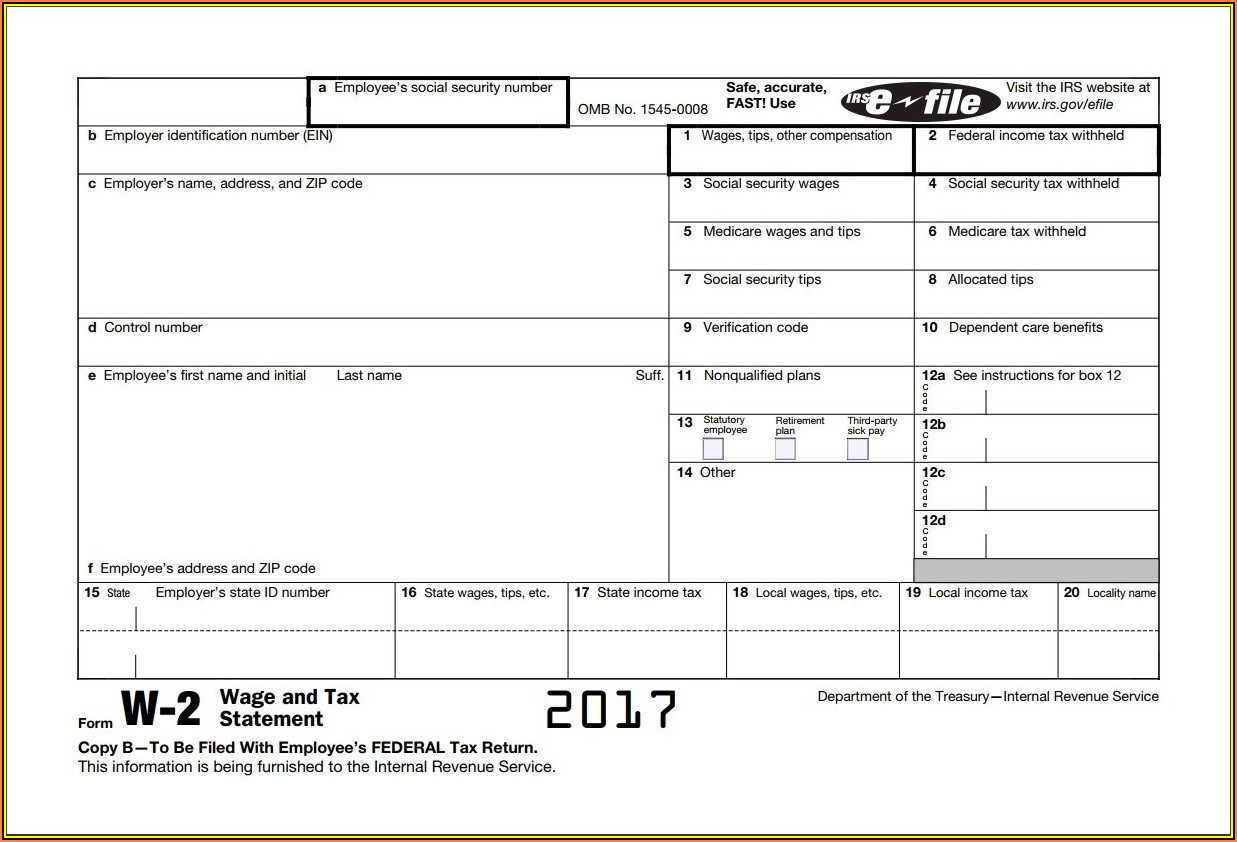

What is a W2 Form?

A W2 form, officially titled "Wage and Tax Statement," is a crucial document issued by your employer (in this case, Deloitte) that reports your annual wages and the amount of taxes withheld. It's essential for filing your federal and state income tax returns. Understanding the information contained within your Deloitte W2 is key to accurately completing your taxes and avoiding potential penalties.

Key Sections of Your Deloitte W2 and What They Mean:

- Employer Identification Number (EIN): Deloitte's unique tax identification number.

- Employee Social Security Number (SSN): Your personal Social Security number.

- Wages, tips, other compensation (Box 1): Your gross earnings for the year, before any deductions. This is the total amount Deloitte paid you.

- Federal income tax withheld (Box 2): The amount of federal income tax Deloitte withheld from your paycheck throughout the year.

- Social Security wages (Box 3): Wages subject to Social Security tax.

- Social Security tax withheld (Box 4): The amount of Social Security tax withheld from your paycheck.

- Medicare wages and tips (Box 5): Wages subject to Medicare tax.

- Medicare tax withheld (Box 6): The amount of Medicare tax withheld from your paycheck.

- Social Security tips (Box 7): This box is usually blank for most Deloitte employees unless you received tips as part of your compensation.

- Allocated tips (Box 8): This box is also generally blank unless you received allocated tips.

- State income tax (Box 16, 17, etc.): This section will vary depending on your state of employment and will show the state income tax withheld. The specific box numbers will depend on your state.

Common Questions Former Deloitte Employees Ask:

-

What if I don't receive my W2 by the January 31st deadline? Contact your former Deloitte HR department immediately. They can help track down your W2 or provide you with a copy.

-

My W2 shows incorrect information. What should I do? Contact Deloitte HR to report the error and request a corrected W2. This is crucial for accurate tax filing.

-

I'm a former contractor. Do I receive a 1099 instead of a W2? If you were an independent contractor, you'd receive a 1099-NEC form, not a W2. The tax implications differ significantly. Consult a tax professional for guidance.

-

Where can I find my W2 online? Deloitte might offer online access to W2s through their employee portal. Check your former employee resources for details.

Tips for Managing Your Deloitte W2:

-

Keep a secure copy: Store your W2 in a safe place, both physical and digital. Consider scanning it and storing it in cloud storage.

-

Review thoroughly: Before filing your taxes, double-check all the information on your W2 for accuracy.

-

Consult a tax professional: If you have complex tax situations, such as stock options or other forms of compensation, it’s highly recommended to consult a tax professional or accountant to ensure accurate filing.

Conclusion:

Your Deloitte W2 is a critical document for accurate tax preparation. By understanding its contents and taking the necessary steps to obtain and review it carefully, you can navigate the tax season smoothly. Remember to contact Deloitte HR if you encounter any issues. This guide provides a solid foundation for understanding your W2, but always consult with a tax professional for personalized advice.

Disclaimer: This information is for general guidance only and does not constitute professional tax advice. Consult a qualified tax professional for advice tailored to your specific circumstances.