Texas Take-Home Pay Calculator: A Complete Guide for 2024

Navigating your finances in Texas can be tricky, especially when it comes to understanding your take-home pay. Knowing exactly how much money you'll actually receive after taxes and deductions is crucial for budgeting, saving, and planning your future. That's where a Texas take-home pay calculator becomes an invaluable tool. This comprehensive guide will walk you through everything you need to know about these calculators and how to use them effectively in 2024.

Understanding Your Texas Take-Home Pay

Before diving into calculators, let's clarify what influences your net income (take-home pay) in Texas. Several factors play a role:

- Federal Income Tax: The federal government levies income tax based on your taxable income, determined by your filing status (single, married filing jointly, etc.) and income bracket.

- State Income Tax: Unlike some states, Texas does not have a state income tax. This is a significant advantage for residents, often resulting in higher take-home pay compared to states with state income taxes.

- Social Security and Medicare Taxes (FICA): These taxes fund Social Security and Medicare programs. Both employer and employee contribute.

- Local Taxes: Depending on your city or county, you might face additional local taxes.

- Deductions and Withholdings: These can include pre-tax deductions like 401(k) contributions, health insurance premiums, and others based on your employer's benefit plan.

How a Texas Take-Home Pay Calculator Works

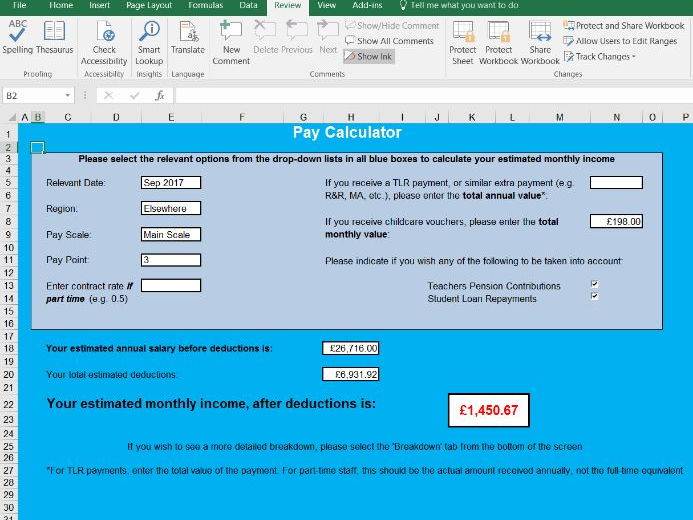

A Texas take-home pay calculator simplifies the complex process of calculating your net income. These online tools typically require you to input the following information:

- Gross Pay: Your total earnings before any deductions.

- Filing Status: Your tax filing status (single, married filing jointly, etc.).

- Number of Allowances: This relates to the number of dependents you claim.

- Pre-tax Deductions: Any deductions from your pay before taxes are calculated. This can include 401(k) contributions, health insurance premiums, etc.

- Additional Withholdings: This allows you to adjust your withholding to account for other deductions or income sources.

The calculator then uses the latest tax laws and withholding tables to estimate your take-home pay, subtracting all relevant taxes and deductions. Many calculators offer different scenarios, allowing you to see how changes in your gross pay, deductions, or filing status affect your net income.

Finding a Reliable Texas Take-Home Pay Calculator

Numerous websites offer take-home pay calculators. When selecting one, ensure it:

- Is up-to-date: Tax laws change, so use a calculator updated for the current year (2024).

- Is from a reputable source: Look for calculators from established financial websites, payroll software providers, or government agencies. Be wary of unreliable sources.

- Clearly explains its calculations: A transparent calculator will show you the breakdown of taxes and deductions, helping you understand your net pay.

Benefits of Using a Texas Take-Home Pay Calculator

Using a Texas take-home pay calculator offers several advantages:

- Accurate Budgeting: Knowing your exact net income enables accurate budgeting and financial planning.

- Debt Management: It assists in managing debt responsibly by accurately estimating your disposable income.

- Saving Goals: It helps in setting realistic saving goals based on your actual take-home pay.

- Tax Planning: While not a substitute for professional tax advice, it can give you a general understanding of your tax liability.

Beyond the Calculator: Further Financial Planning

While a Texas take-home pay calculator is a valuable tool, it's essential to remember it provides an estimate. Your actual take-home pay might slightly vary due to unforeseen factors. For comprehensive financial planning, consider consulting a financial advisor. They can help you create a personalized plan based on your individual circumstances and goals.

Conclusion

A Texas take-home pay calculator is a powerful resource for understanding your finances in 2024. By using a reliable calculator and understanding the factors that influence your net income, you can make informed financial decisions and achieve your financial goals. Remember to utilize this tool responsibly and seek professional advice when needed for comprehensive financial planning.

Disclaimer: This article provides general information and should not be considered professional financial or tax advice. Consult with a qualified professional for personalized advice.