San Leandro, CA Sales Tax Rate: Your Complete Guide

Shopping in San Leandro, California? Understanding the sales tax rate is crucial for budgeting and accurate financial record-keeping. This comprehensive guide breaks down everything you need to know about the current San Leandro sales tax, ensuring you're fully informed before your next purchase.

What is the current sales tax rate in San Leandro, CA?

As of October 26, 2023, the total sales tax rate in San Leandro, CA is 9.25%. This is a combination of state, county, and district taxes. It's important to remember that this is a combined rate; you won't see individual breakdowns on your receipt.

Breakdown of San Leandro Sales Tax Components:

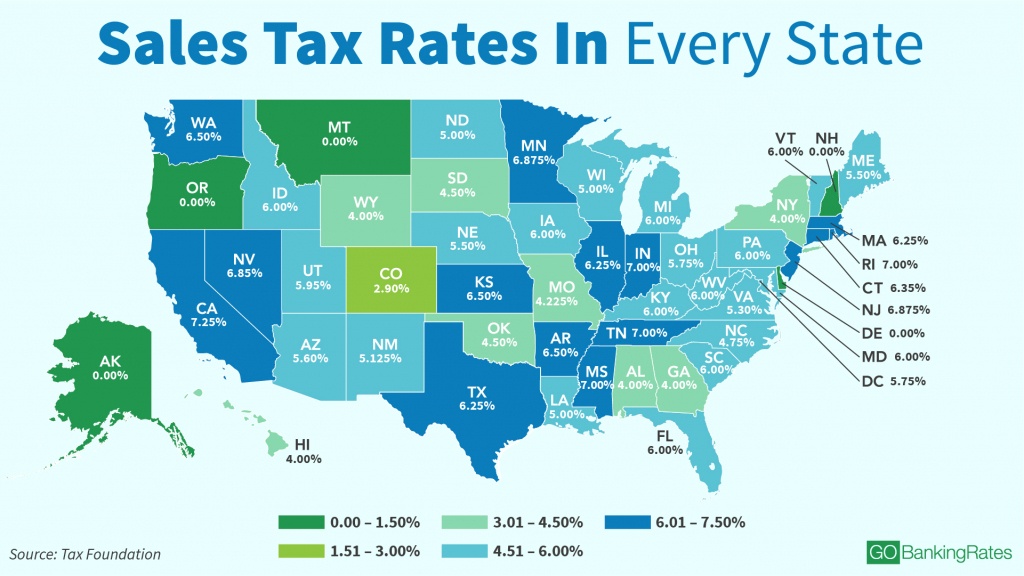

- State Sales Tax: 7.25% (This is the base California state sales tax rate.)

- Alameda County Sales Tax: 1%

- San Leandro District Sales Tax: 1%

Why is understanding the sales tax rate important?

Knowing the exact sales tax rate is vital for several reasons:

- Accurate Budgeting: Incorporating sales tax into your budget ensures you don't overspend or experience unexpected financial shortfalls.

- Business Accounting: For businesses operating in San Leandro, accurate sales tax calculations are essential for complying with tax regulations and avoiding penalties.

- Negotiating Prices: Understanding the sales tax can help you negotiate better deals, particularly on larger purchases.

- Comparing Prices: When comparing prices between different stores or locations, remember to factor in the sales tax to get a true picture of the overall cost.

Potential Changes to the San Leandro Sales Tax Rate:

Sales tax rates can change. It's recommended to check with the California Department of Tax and Fee Administration (CDTFA) for the most up-to-date information before making significant purchases or filing tax returns. You can find their website by searching "California Department of Tax and Fee Administration". Local government websites, such as the City of San Leandro's official website, can also provide updates on any proposed changes.

Tips for Managing Sales Tax:

- Use a Sales Tax Calculator: Several online sales tax calculators are available to help you quickly and accurately calculate the total cost, including sales tax.

- Keep Receipts: Maintain accurate records of your receipts for tracking purposes and in case of any discrepancies.

- Stay Informed: Regularly check for updates on sales tax rates to ensure your financial planning remains accurate.

Beyond Sales Tax in San Leandro:

While this guide focuses on sales tax, understanding other local taxes and fees is also important for residents and businesses in San Leandro. This might include property taxes, business license fees, and other local levies. For comprehensive information on all local taxes, consult the City of San Leandro's official website or contact the relevant government agencies.

Conclusion:

Understanding the San Leandro, CA sales tax rate is crucial for both personal and business financial management. By utilizing the resources and tips outlined in this guide, you can ensure accuracy in your budgeting and accounting, leading to better financial planning and compliance. Remember to check for updates regularly to stay informed about any changes to the sales tax rate.

Keywords: San Leandro sales tax, San Leandro CA sales tax rate, California sales tax, Alameda County sales tax, sales tax calculator, California Department of Tax and Fee Administration, CDTFA, San Leandro tax rate, CA sales tax, business tax, budgeting, financial planning.