Miami-Dade County Property Tax Estimator: Accurate Predictions for Your 2024 Tax Bill

Are you a Miami-Dade County homeowner dreading the arrival of your 2024 property tax bill? Uncertainty about rising property values and potential tax increases can be stressful. Fortunately, several reliable Miami-Dade County property tax estimators can provide accurate predictions, allowing you to budget effectively and avoid unpleasant surprises. This article will explore the tools available, highlight their accuracy, and offer tips for navigating the process.

Understanding Miami-Dade County Property Taxes

Before diving into the estimators, it's crucial to understand the fundamentals of Miami-Dade County property taxes. Your tax bill is calculated based on the assessed value of your property, which is determined by the Miami-Dade County Property Appraiser's office. This assessed value is often, but not always, lower than the market value. The tax rate, set by the county and various municipalities, is then applied to the assessed value to determine your total tax liability. Several factors influence your assessed value, including:

- Market conditions: A booming real estate market will generally lead to higher assessed values.

- Property improvements: Renovations, additions, and upgrades can increase your assessed value.

- Comparable sales: The Property Appraiser's office considers recent sales of similar properties in your area.

Utilizing Miami-Dade County Property Tax Estimators

Several resources provide property tax estimations for Miami-Dade County. While not all offer the same level of precision, they can offer a valuable insight into your potential 2024 tax liability:

-

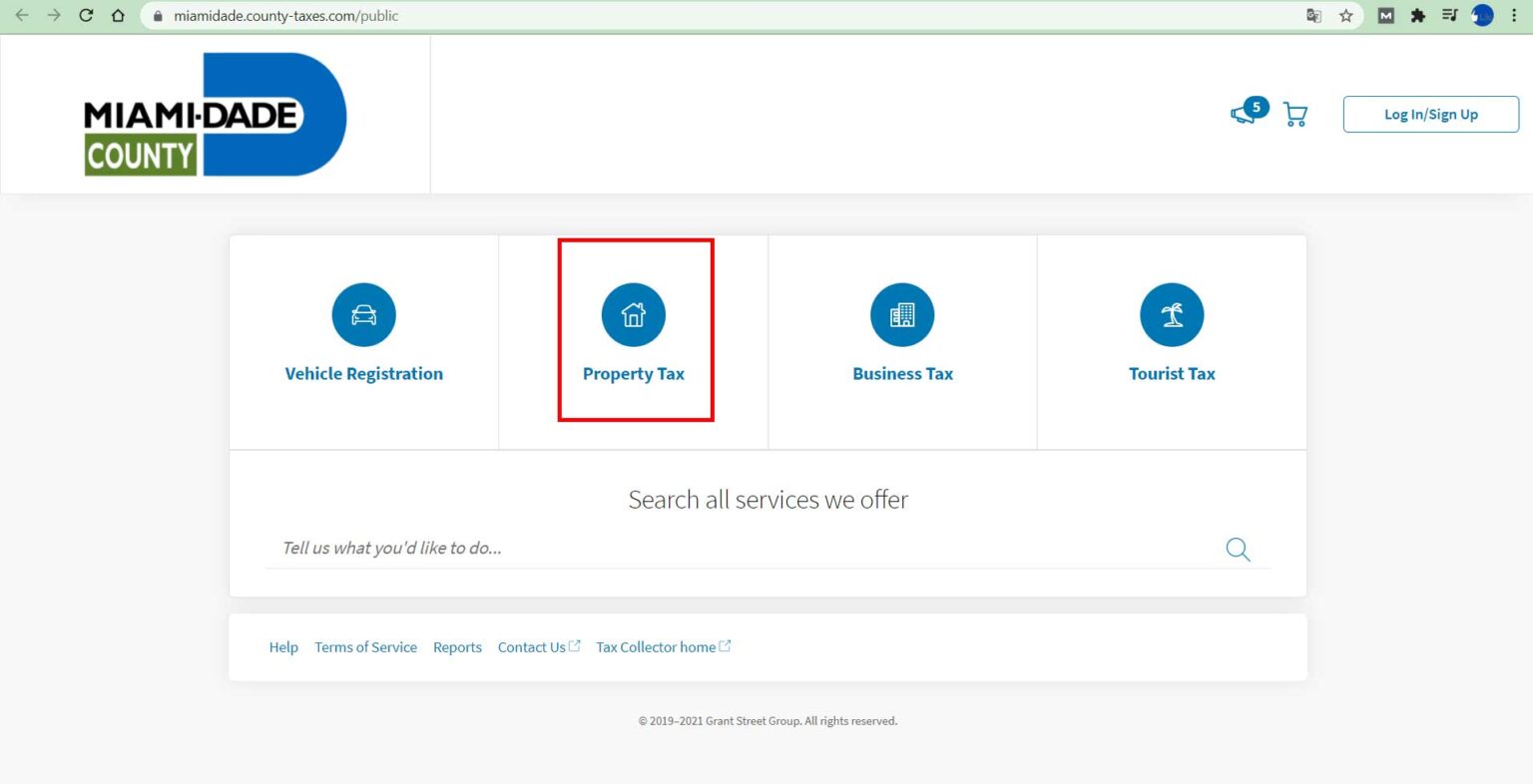

Miami-Dade County Property Appraiser's Website: This is the most reliable source. While they may not offer a dedicated "estimator" tool, their website provides access to your property's assessed value and details about the tax rates. By using this information, you can calculate a fairly accurate estimate yourself. Be sure to check for updates on the website as tax rates and assessed values can change.

-

Third-Party Property Tax Estimators: Numerous online platforms offer property tax estimation services. These often utilize algorithms that consider various data points, including your property's address, recent sales data, and current tax rates. While convenient, it's essential to use reputable sources and cross-reference their estimations with data from the official Property Appraiser's website. Always double-check their calculations and terms of service.

-

Real Estate Agents: Local real estate agents often have access to detailed property data and market insights. They can provide valuable estimations based on their expertise and knowledge of the local market. However, remember that this is not an official source, and you should still independently verify.

Tips for Accurate Predictions

To maximize the accuracy of your property tax estimations:

- Verify your property details: Ensure all information you input into any estimator is accurate, including your address and any recent property improvements.

- Compare multiple sources: Don't rely on a single estimator. Compare results from several sources to get a more comprehensive picture.

- Consult a tax professional: For complex property situations or if you have questions regarding exemptions or appeals, seeking advice from a qualified tax professional is recommended.

Preparing for Your 2024 Tax Bill

Accurate property tax predictions are essential for sound financial planning. By utilizing the resources and tips outlined above, you can effectively budget for your 2024 tax bill and avoid any unexpected financial strain. Don't hesitate to reach out to the Miami-Dade County Property Appraiser's office or a qualified professional for assistance. Staying informed is key to responsible property ownership.

Call to Action: Visit the Miami-Dade County Property Appraiser's website today to access your property's details and start planning for your 2024 property taxes. [Link to Miami-Dade County Property Appraiser's Website]