Mastering Order Flow Trading with TradingView: Analyzing isl9 Oil Capacity

The energy market is a complex beast, and understanding its intricacies is crucial for successful trading. One particularly potent tool for navigating this complexity is order flow trading, and when combined with the powerful visualization capabilities of TradingView, it becomes a formidable strategy. This article will delve into how to master order flow trading using TradingView, specifically focusing on analyzing the impact of isl9 oil capacity on price movements.

What is Order Flow Trading?

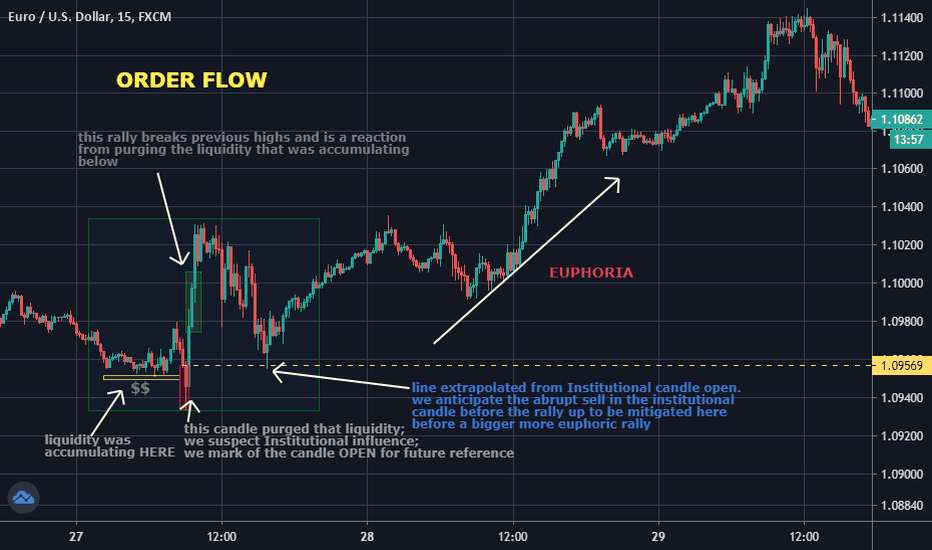

Order flow trading focuses on analyzing the underlying order book – the aggregated buy and sell orders – to anticipate price movements. Unlike traditional technical analysis which relies solely on price charts, order flow trading considers the volume and liquidity behind those price movements. This allows traders to identify areas of strong support and resistance, predict potential breakouts, and anticipate market reversals before they happen.

TradingView: Your Order Flow Analysis Hub

TradingView offers a robust platform for conducting detailed order flow analysis. Its customizable charts, combined with a wide array of indicators and drawing tools, make it an ideal environment for interpreting market dynamics. Crucially, TradingView allows you to overlay various order flow indicators onto your charts, providing a comprehensive view of the underlying market forces.

Analyzing isl9 Oil Capacity with TradingView

isl9 oil capacity, often a significant factor influencing global oil prices, presents a unique opportunity to leverage order flow analysis. By carefully monitoring the order book around significant news releases or announcements related to isl9 capacity, traders can identify potential price shifts before the broader market reacts.

Here's how you can do it:

- Identify Key Levels: Using TradingView, identify significant price levels where large orders are accumulating. This could be a level of strong support or resistance related to isl9 oil capacity news.

- Volume Analysis: Observe volume profiles alongside price action. High volume trades around key levels suggest significant market participation, reinforcing the importance of those levels.

- Order Book Depth: Utilize TradingView’s order book functionality (if available on your plan) to gauge the depth of liquidity at crucial price points. A shallow order book suggests potential for rapid price movements.

- Market Profile: Combine order flow analysis with the Market Profile tool in TradingView to identify areas of high value area (HVA) and point of control (POC). These areas often correlate with significant support and resistance levels.

- News Sentiment Integration: Integrate news sentiment analysis (using external tools or feeds) into your TradingView setup to gauge market reaction to isl9 capacity updates. This will allow you to anticipate how order flow might react to positive or negative news.

Example Scenario:

Imagine a news report detailing a significant decrease in isl9 oil capacity. Using TradingView, you observe a large accumulation of sell orders at a key resistance level. Coupled with low volume on the buy side, this suggests a high probability of a price decline. A well-timed short position, informed by this order flow analysis, could yield substantial profits.

Mastering the Art:

Mastering order flow trading on TradingView requires practice and patience. Start by backtesting your strategies on historical data, then gradually transition to live trading with small positions. Continuous learning and adaptation are crucial, as market conditions and order flow dynamics can change rapidly.

Conclusion:

Order flow trading, particularly when combined with the power of TradingView, offers a sophisticated approach to trading the energy market. By analyzing isl9 oil capacity and its influence on the order book, traders can improve their prediction accuracy and enhance their trading performance. Remember to always manage risk responsibly and never invest more than you can afford to lose. Start exploring the possibilities today!