Maricopa County Property Tax Payment: A Complete Guide

Paying your property taxes on time is crucial to avoid penalties and maintain good standing with Maricopa County. This comprehensive guide will walk you through everything you need to know about paying your Maricopa County property taxes, ensuring a smooth and stress-free process.

Understanding Your Maricopa County Property Tax Bill

Before diving into payment methods, let's understand the components of your tax bill. Your bill will typically include:

- Assessment: The assessed value of your property, determined by the Maricopa County Assessor's Office. This value is based on factors like property size, location, and condition.

- Tax Rate: The tax rate applied to your assessed value, determined by various taxing entities within Maricopa County (schools, cities, etc.).

- Total Tax Due: The final amount you owe, calculated by multiplying your assessed value by the tax rate.

- Payment Due Date: The deadline for paying your property taxes without incurring penalties. This date is usually November 1st and March 1st for the two installments.

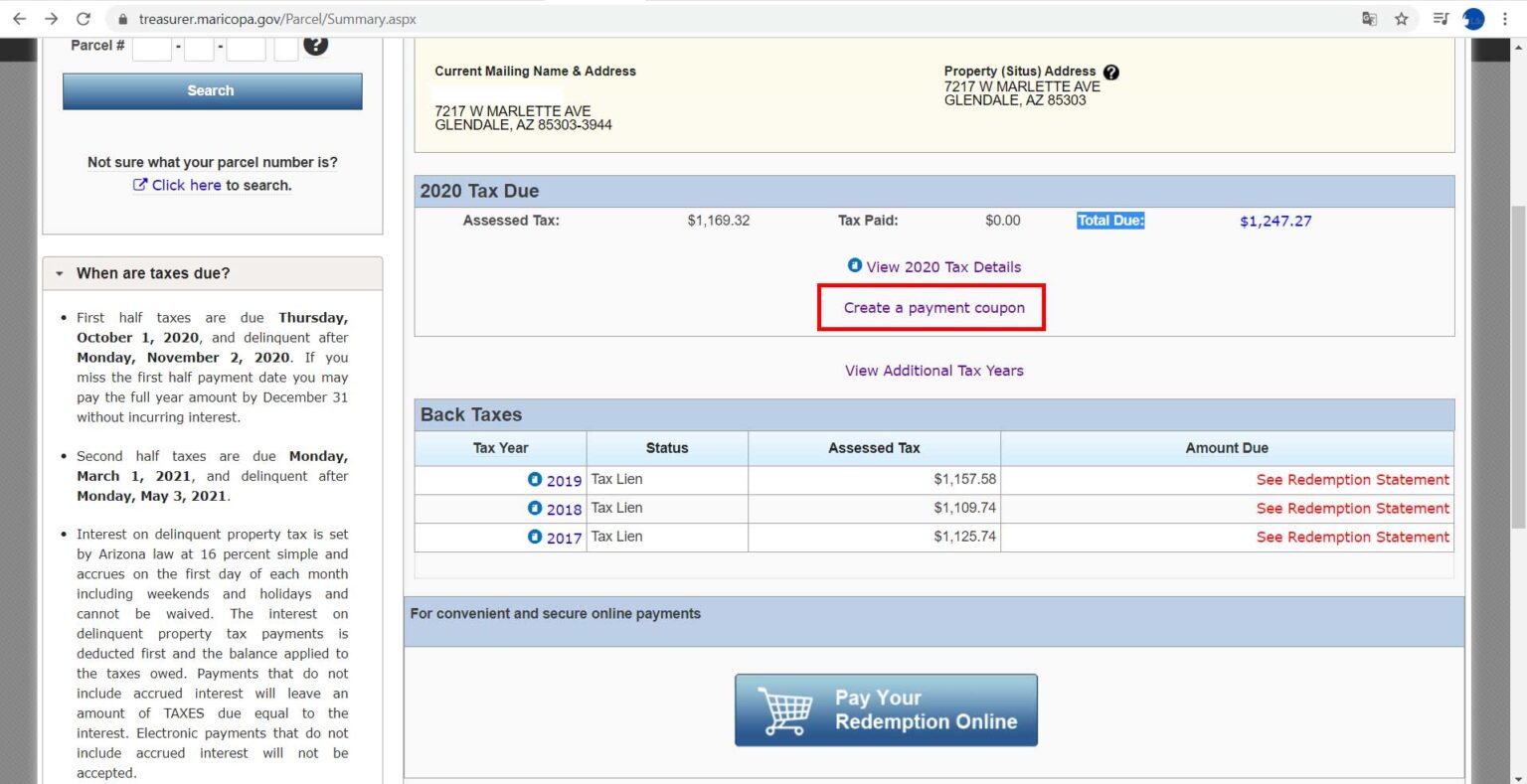

Finding Your Property Tax Information

You can access your property tax information online through the Maricopa County Treasurer's website. This is the most convenient way to view your bill, check your payment history, and make payments. You'll typically need your property address or parcel number to access your account.

Multiple Ways to Pay Your Maricopa County Property Taxes

Maricopa County offers several convenient payment options to suit your needs:

- Online Payment: The fastest and most convenient way to pay is online through the Treasurer's website. You can typically pay using a debit card, credit card (with a small processing fee), or electronic check.

- Mail Payment: You can mail your payment along with the remittance stub included with your tax bill. Ensure you mail your payment well in advance of the deadline to avoid late penalties. The mailing address is usually printed on your tax bill.

- In-Person Payment: You can pay in person at the Maricopa County Treasurer's Office. Check their website for hours of operation and locations.

- Drop Box Payment: Many locations offer secure drop boxes where you can leave your payment. However, it's always best to check the Treasurer's website for confirmed drop box locations and to confirm they are accepting payments this way before using this method.

Avoiding Late Payment Penalties

Late payment penalties can significantly increase your total due. Therefore, always prioritize paying your property taxes on time. Penalties are usually a percentage of the unpaid amount and can compound over time.

Frequently Asked Questions (FAQs)

- What happens if I can't afford to pay my property taxes? Contact the Maricopa County Treasurer's Office immediately to discuss payment options, such as installment agreements.

- How can I appeal my property assessment? You can appeal your property assessment through the Maricopa County Assessor's Office. The appeal process has specific timelines, so it is crucial to familiarize yourself with those procedures and deadlines.

- Where can I find more information? The official website of the Maricopa County Treasurer's Office is the best resource for detailed information, FAQs, and up-to-date details on payment procedures.

Conclusion:

Paying your Maricopa County property taxes is a straightforward process when you understand the options available. By utilizing the online portal and paying on time, you can avoid penalties and ensure a smooth interaction with the county. Remember to always refer to the official Maricopa County Treasurer's website for the most accurate and up-to-date information. Don't hesitate to contact them directly if you have any questions or concerns.

(Remember to replace bracketed information with actual links to the Maricopa County Treasurer's and Assessor's websites)