Jackson County MO Property Tax Search: Your Guide to Finding Property Tax Information

Finding property tax information in Jackson County, MO can feel like navigating a maze. But it doesn't have to be! This comprehensive guide will walk you through the process of conducting a Jackson County MO property tax search, providing you with all the tools and resources you need. Whether you're a homeowner, a potential buyer, or simply curious about property values, this guide has you covered.

Understanding Jackson County Property Taxes

Before diving into the search process, it's helpful to understand the basics of property taxes in Jackson County. Property taxes fund essential services like schools, public safety, and infrastructure. The amount you pay depends on the assessed value of your property and the tax rates set by various taxing entities. These entities include:

- Jackson County: This covers county-wide services.

- Independent School Districts: Funding for local schools varies depending on your location within the county.

- Cities & Municipalities: Taxes support local services like parks, libraries, and police departments.

Understanding these different taxing authorities helps you interpret the information you find during your property tax search.

How to Conduct a Jackson County MO Property Tax Search

There are several ways to access Jackson County MO property tax information:

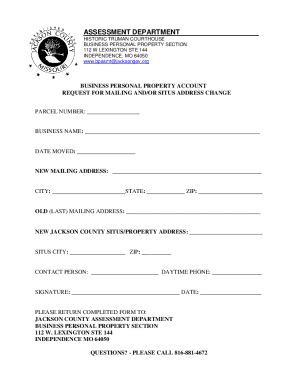

1. The Jackson County Assessor's Website: Your Primary Resource

The Jackson County Assessor's website is your primary source for accurate and up-to-date property tax information. Here you'll typically find:

- Property Search: Use this tool to search by address, owner name, or parcel ID number.

- Tax Information: Once you find your property, you'll access details like assessed value, tax rate, and the amount of taxes owed.

- Tax Payment Options: The website usually outlines various ways to pay your property taxes, including online payment options.

- Assessment Appeals: Information on how to appeal your property assessment if you believe it's inaccurate.

Pro-Tip: Bookmark the Assessor's website for easy access.

2. Third-Party Property Tax Search Websites

Several third-party websites offer property tax information, including some that aggregate data from multiple counties. While convenient, always verify the information found on these sites against the official Jackson County Assessor's website. These sites may not always be completely up to date.

3. Contacting the Jackson County Assessor's Office Directly

If you encounter difficulties using the online resources, don't hesitate to contact the Jackson County Assessor's office directly by phone or email. They can provide assistance and answer any questions you may have.

Interpreting Your Property Tax Information

Once you've found your property tax information, understanding the details is crucial. Key terms to be aware of include:

- Assessed Value: The value assigned to your property for tax purposes. This is often different from the market value.

- Tax Rate (Mill Rate): Expressed in mills (1 mill = $0.001 per dollar of assessed value). This rate determines the amount of taxes you owe.

- Tax Levy: The total amount of taxes owed for the tax year.

Beyond the Basics: Additional Resources & Considerations

- Understanding Property Tax Appeals: If you believe your property's assessed value is inaccurate, you have the right to appeal. The Assessor's website will provide information on the appeals process.

- Property Tax Exemptions: Certain homeowners may qualify for property tax exemptions, reducing their tax burden. Explore the eligibility requirements on the Assessor's website.

- Future Tax Changes: Stay informed about potential changes in property tax laws and rates by regularly checking the Assessor's website and local news sources.

Conclusion

Navigating Jackson County MO property tax information doesn't have to be daunting. By utilizing the resources and strategies outlined in this guide, you can easily find the information you need and ensure you're managing your property taxes effectively. Remember to always verify information from third-party sources with the official Jackson County Assessor's website. Start your search today!