IRS Austin Submission Processing Center: Address and Important Information

Are you sending documents to the IRS? Knowing the correct address for the IRS Austin Submission Processing Center is crucial for ensuring your documents are processed efficiently. This article provides the official address, important information about accepted submissions, and helpful tips to expedite your processing time.

Understanding the IRS Austin Submission Processing Center

The IRS Austin Submission Processing Center is one of several IRS facilities responsible for receiving and processing various tax-related documents. It plays a vital role in the efficient operation of the IRS, handling a significant volume of mail daily. Understanding its function and knowing the correct address is key to avoiding delays and ensuring your correspondence reaches the right destination.

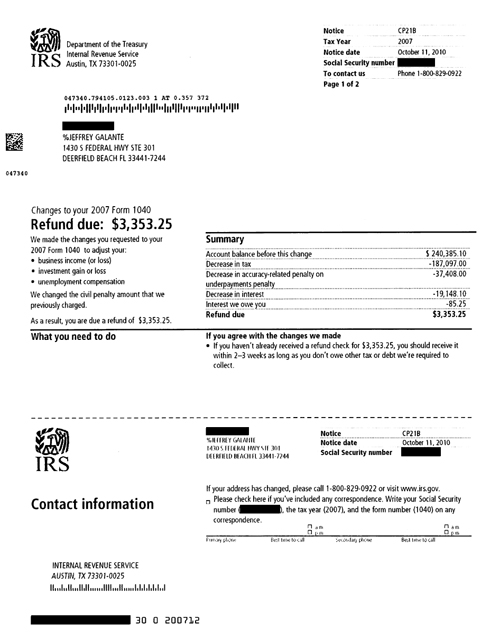

Official Address and Contact Information:

While specific addresses can change, you should always verify the most up-to-date address through the official IRS website. Directly searching for "IRS Austin Submission Processing Center address" on the IRS website is the safest method. Avoid relying on outdated information found on unofficial websites or forums.

What Documents are Accepted at the IRS Austin Submission Processing Center?

The IRS Austin Submission Processing Center handles a range of documents, including but not limited to:

- Tax returns: This includes both individual and business tax returns. Ensure your return is properly completed and signed before mailing.

- Amendments: If you need to correct information on a previously filed return, you'll send the amendment to the appropriate processing center.

- Payment: While online payment is often preferred, you might need to mail in payments in certain circumstances.

- Forms and correspondence: Various IRS forms and supporting documentation may be sent to this center.

Important Considerations:

- Accurate Addressing: Double-check the address on the IRS website and ensure your envelope is clearly labeled with the correct address and your return information. Incorrect addressing significantly delays processing.

- Certified Mail: Consider using certified mail with return receipt requested for important documents. This provides proof of delivery and can be helpful in case of any disputes.

- Tracking: If you are mailing valuable documents, utilize a mail service that allows you to track the package's progress.

- Deadlines: Remember to submit your documents before the relevant deadlines to avoid penalties. The IRS website provides detailed information on deadlines for various filings.

- IRS Website: The official IRS website (irs.gov) is the ultimate source of information. Check there for the most up-to-date details.

Alternatives to Mailing:

While mailing to the IRS Austin Submission Processing Center remains an option, the IRS strongly encourages taxpayers to utilize online services whenever possible. Online portals offer increased convenience and faster processing times.

- IRS.gov: File your taxes online, make payments, and access various IRS services through the official website.

- IRS2Go mobile app: Manage your tax information conveniently through the IRS's mobile application.

Conclusion:

Knowing the correct address for the IRS Austin Submission Processing Center and understanding the types of documents accepted is crucial for timely tax processing. Always verify the address on the official IRS website before mailing any documents. By following these guidelines, you can ensure your correspondence reaches its destination efficiently. Remember, using online services whenever possible can significantly streamline the process.

Keywords: IRS Austin Submission Processing Center, IRS address, tax documents, tax returns, IRS mailing address, IRS processing center, IRS Austin, tax payment, amend tax return, IRS forms, tax filing, IRS website, IRS2Go.