How to Obtain a Former Employee's W-2: A Step-by-Step Guide

Losing a W-2 form can be incredibly frustrating, especially during tax season. For former employees, tracking down a misplaced or missing W-2 can feel like navigating a bureaucratic maze. This comprehensive guide provides a step-by-step approach to obtaining a copy of your old W-2, regardless of the reason for its absence.

Why You Might Need Your Old W-2

Before we dive into the retrieval process, let's understand why you might need a copy of your old W-2. Common reasons include:

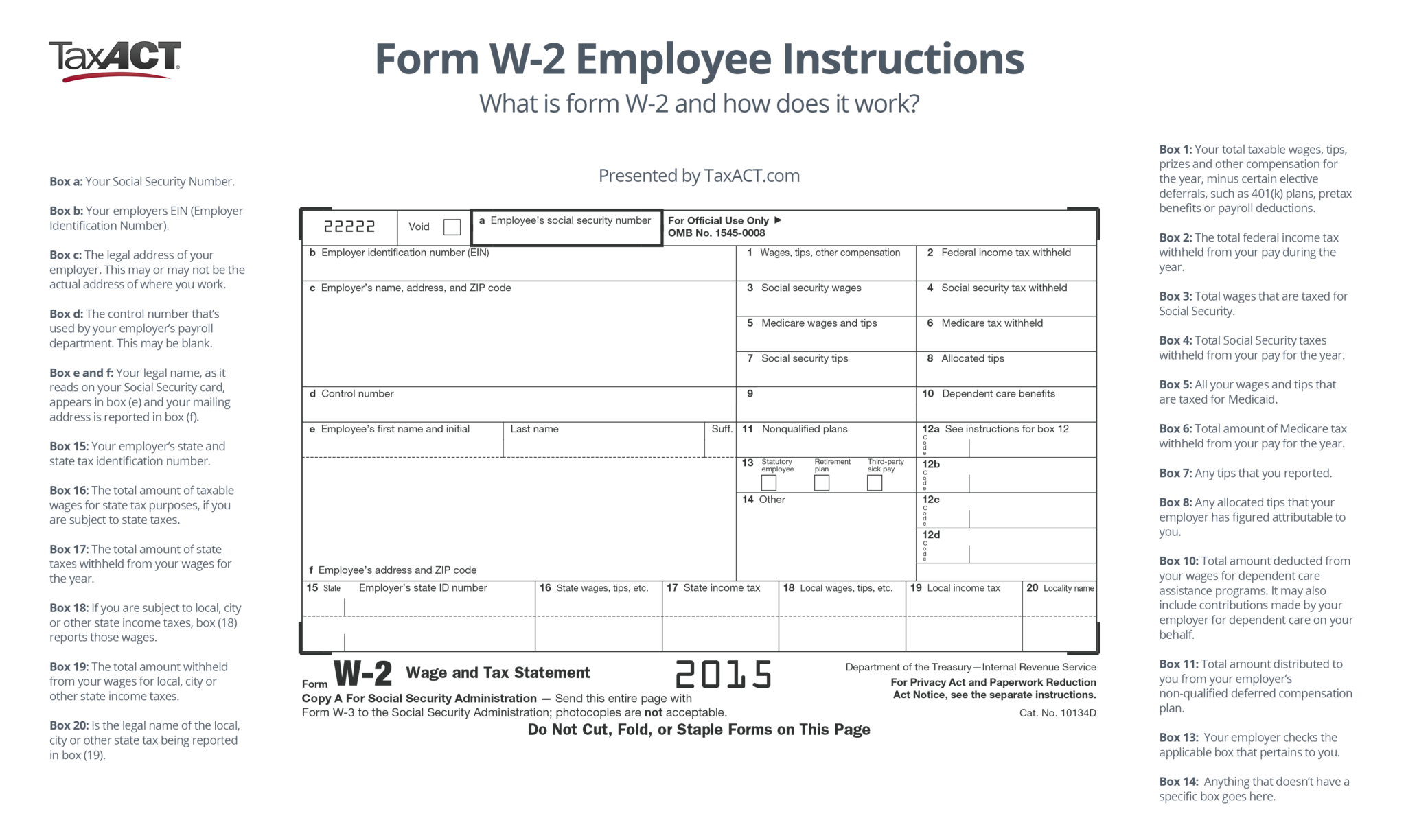

- Filing your taxes: The most common reason. Your W-2 reports your wages and the taxes withheld, crucial information for accurate tax filing.

- Correcting tax errors: If you discover an error on your previously filed tax return, you'll need your W-2 to support your corrections.

- Applying for a loan: Some lenders require tax documentation, including W-2s, as part of the application process.

- Proof of income: A W-2 can serve as proof of income for various purposes, such as rental applications or benefit programs.

Step-by-Step Guide to Obtaining Your Former Employee's W-2

1. Check Your Personal Records:

Begin with the simplest step: search your personal files, both physical and digital. Many people keep important documents like tax returns and pay stubs, which often include a copy of the W-2.

2. Contact Your Former Employer:

This is often the most effective method. Contact your former employer's human resources (HR) department or payroll department. Be prepared to provide information such as:

- Your full name

- Your Social Security number (SSN)

- Your dates of employment

- The tax year in question

Most companies maintain records of W-2s for several years and are legally obligated to provide you with a copy upon request.

3. Utilize the IRS's Resources:

If contacting your former employer is unsuccessful, the IRS offers several resources:

- Form W-2c, Corrected Wage and Tax Statement: If you believe your W-2 contains errors, you can use this form to request corrections from your employer.

- Get Transcript Online: The IRS website allows you to access tax transcripts online, which include information from your W-2. While not a direct copy of the W-2 itself, it provides the necessary data for tax filing.

4. Consider Professional Tax Help:

If you've exhausted all other avenues, consider seeking help from a tax professional. They have experience dealing with missing tax documents and can assist you in obtaining the necessary information.

Tips for Preventing Future W-2 Mishaps:

- Create a secure filing system: Implement a robust system for storing important financial documents, both physically and digitally.

- Scan and digitize: Scan important documents and store them securely in the cloud or on an external hard drive.

- Automatic filing: Many employers offer electronic W-2 delivery. Opting for this can significantly reduce the risk of losing your W-2.

Conclusion:

Obtaining a lost or misplaced W-2 can be challenging, but by following these steps, you can significantly increase your chances of success. Remember to be patient, persistent, and proactive in your approach. If you have any questions or encounter difficulties, don't hesitate to seek assistance from the IRS or a tax professional.

Keywords: W-2, former employee, missing W-2, tax season, IRS, payroll, human resources, tax documents, get W-2, obtain W-2, tax transcript, lost W-2, how to get W-2

Disclaimer: This article provides general information and should not be considered professional tax advice. Consult with a qualified tax professional for personalized guidance.