How to Obtain a Former Employee's W-2: A Practical Guide

Losing a W-2 form can be incredibly stressful, especially when tax season is fast approaching. Whether you're a former employee needing your W-2 for tax filing or an employer assisting a past employee, navigating the process of obtaining a missing W-2 can feel overwhelming. This comprehensive guide provides a practical, step-by-step approach to retrieving your or a former employee's W-2, regardless of the reason for its absence.

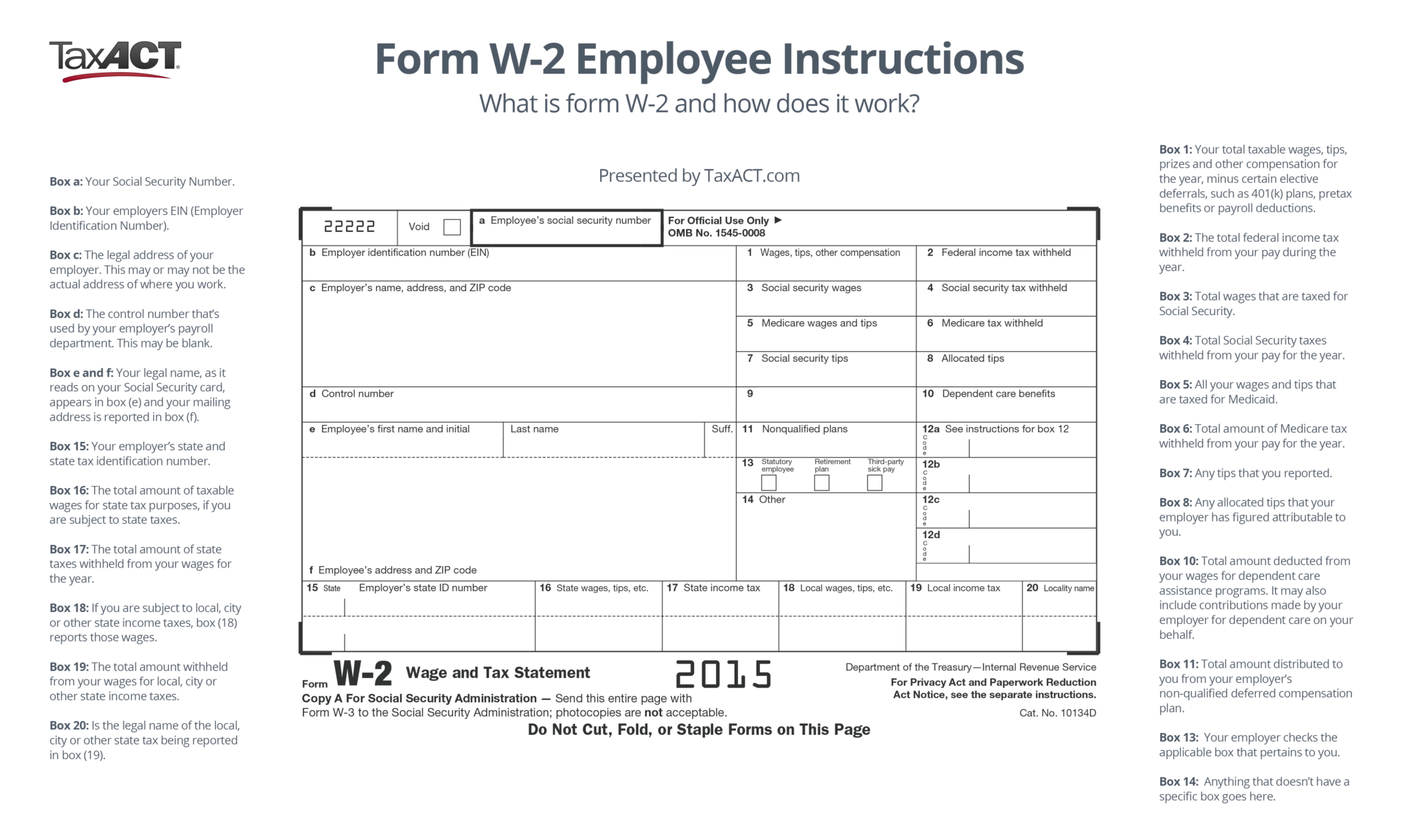

Understanding the Importance of W-2 Forms

Before diving into the retrieval process, let's quickly reiterate why obtaining your W-2 is so crucial. A W-2, or Wage and Tax Statement, is a vital document that reports your earnings and the amount of taxes withheld from your paycheck during the tax year. Without it, accurately filing your taxes becomes extremely difficult, potentially leading to delays and penalties.

How to Obtain a Former Employee's W-2: A Step-by-Step Guide

For Former Employees:

-

Contact Your Former Employer: This is the first and often the most effective step. Call your former employer's human resources (HR) department or payroll office. Be prepared to provide identifying information like your full name, social security number (SSN), and dates of employment. Many companies have secure online portals where you can access your W-2. Inquire about this possibility.

-

Check Your Previous Pay Stubs or Tax Records: Sometimes, a copy of your W-2 may be included with your previous pay stubs or tucked away in your tax records from the previous year. Review these documents thoroughly.

-

Utilize the IRS's Online Portal: The IRS provides an online portal that connects you directly with your employers to request your W-2. This is useful if contacting your previous employer proves difficult. However, keep in mind it is dependent on your previous employer participating in the system.

-

File Form W-2c, Corrected Wage and Tax Statement: If you believe your W-2 contains errors, you can file Form W-2c with the IRS. This requires careful attention to detail and ensures the accuracy of your tax return. Note that this is for correction, not for obtaining a missing document.

For Employers Assisting Former Employees:

-

Access Your Payroll System: Most payroll systems maintain records of issued W-2s. Access your payroll software and locate the relevant employee's W-2.

-

Review Your Company's W-2 Retention Policy: Understand your company's policy regarding the retention of W-2s. Many jurisdictions have legal requirements concerning the retention of payroll records.

-

Provide a Secure Method of Delivery: When providing the W-2 to the former employee, consider using secure methods like email with password protection, secure file transfer services, or certified mail. Never email sensitive information like an employee's SSN in plain text.

-

Address Discrepancies Promptly: If a former employee contacts you regarding a discrepancy on their W-2, address the issue quickly and professionally. You may need to issue a corrected W-2 (Form W-2c).

Important Considerations:

-

Deadlines: Be aware of the IRS's deadlines for filing your taxes. Act quickly to obtain your W-2 to avoid any potential penalties.

-

Security: Protect your personal information, especially your SSN. Be cautious about providing sensitive data online or through email.

-

Legal Obligations: Employers have legal responsibilities concerning the accurate issuance and retention of W-2s.

-

State-Specific Regulations: Some states have their own regulations regarding W-2 forms, so you should check with your state's tax authority if needed.

Conclusion:

Obtaining a missing W-2 can be challenging, but by following these steps, you can significantly increase your chances of retrieving it. Remember to be proactive, persistent, and protect your personal information. If you're still experiencing difficulties after exhausting all options, consider consulting with a tax professional for further assistance. They can offer personalized advice based on your specific situation.