Former Safeway Employee's YouTube Channel Explores W-2 Issues: A Growing Online Resource

A former Safeway employee is making waves online, not with a disgruntled rant, but with a surprisingly helpful YouTube channel dedicated to navigating the complexities of W-2 forms. His channel, which has quickly gained traction, provides valuable insights and resources for anyone struggling to understand their W-2, particularly those working in retail and related industries. This article explores the channel’s impact and the growing need for accessible information on W-2s.

From Checkout Lane to Content Creator: A Unique Journey

Unlike many viral videos born from workplace grievances, this channel focuses on constructive solutions. The creator, who wishes to remain anonymous for privacy reasons but goes by "RetailW2Guy" online, leverages his experience as a long-time Safeway employee to explain the intricacies of W-2 forms in a clear and relatable way. He tackles common questions and concerns, many of which are often overlooked in official government documentation.

This innovative approach to addressing tax-related issues is resonating strongly with viewers. RetailW2Guy’s channel demonstrates the power of personal experience in making complex subjects accessible. Instead of relying solely on dense IRS publications, he provides real-world examples and practical advice.

Key Topics Covered on the Channel:

The channel covers a broad spectrum of W-2 related topics, including:

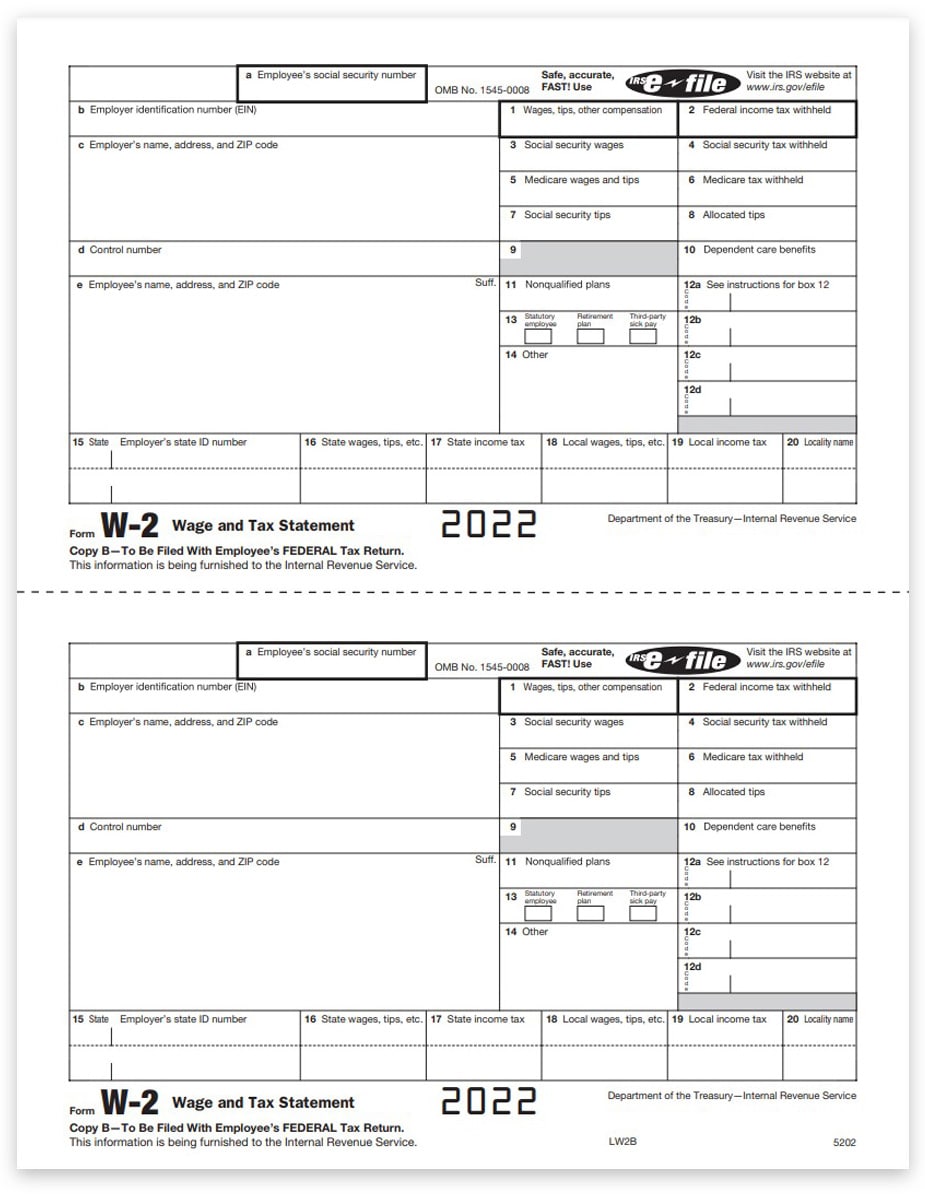

- Understanding W-2 terminology: RetailW2Guy breaks down jargon like "Box 1," "Box 3," and "Social Security Wages" into plain English.

- Common W-2 errors and how to correct them: He highlights potential mistakes often made by employers and employees, along with steps to take if errors are discovered.

- Reconciling W-2s with pay stubs: This crucial step is often confusing, but RetailW2Guy provides a step-by-step guide to ensuring accuracy.

- Filing taxes with your W-2: The channel offers valuable tips for successfully filing your taxes, particularly for those new to the process.

- Specific issues related to retail employment: He addresses questions unique to retail workers, such as tip reporting and fluctuating hours.

Why this Channel Matters:

The success of RetailW2Guy's channel highlights a significant gap in accessible information regarding W-2 forms. Official IRS resources can often be difficult to navigate for those without a strong accounting background. His relatable approach and focus on practical application makes complex information digestible for a wider audience.

The Future of W-2 Education:

RetailW2Guy's initiative suggests a new trend in financial education: the rise of individual creators offering personalized and easily understandable guidance on traditionally complex topics. His channel demonstrates the effectiveness of using personal experience to empower others and bridge the knowledge gap. This approach holds significant promise for making essential financial information more accessible to the general public.

Call to Action:

If you're a retail worker, a recent graduate, or simply looking for a clearer understanding of W-2 forms, check out RetailW2Guy's YouTube channel (link to be added once channel is publicly available). You might be surprised at how much simpler navigating tax season can be! Share this article with anyone who might find it helpful! What other tax-related topics would you like to see explained clearly? Let us know in the comments below.