Find Your Ally Auto Payoff Address: A Simple Guide

Paying off your car loan early can save you a significant amount of money on interest. But before you can celebrate that financial freedom, you need to know where to send your payment. Finding the correct Ally Auto payoff address can seem confusing, but this simple guide will walk you through the process, ensuring your payment arrives safely and on time.

Why Knowing Your Ally Auto Payoff Address is Crucial

Sending your payment to the wrong address can delay your payoff, potentially impacting your credit score and causing unnecessary stress. A misplaced payment can also lead to late fees and further interest accrual, negating the benefits of early payoff. Therefore, obtaining the precise Ally Auto payoff address is paramount.

How to Find Your Ally Auto Payoff Address: Three Easy Methods

Ally Auto provides several convenient ways to locate your payoff address. Here are three methods to ensure you have the correct information:

1. Ally Auto's Online Account: The Fastest and Easiest Method

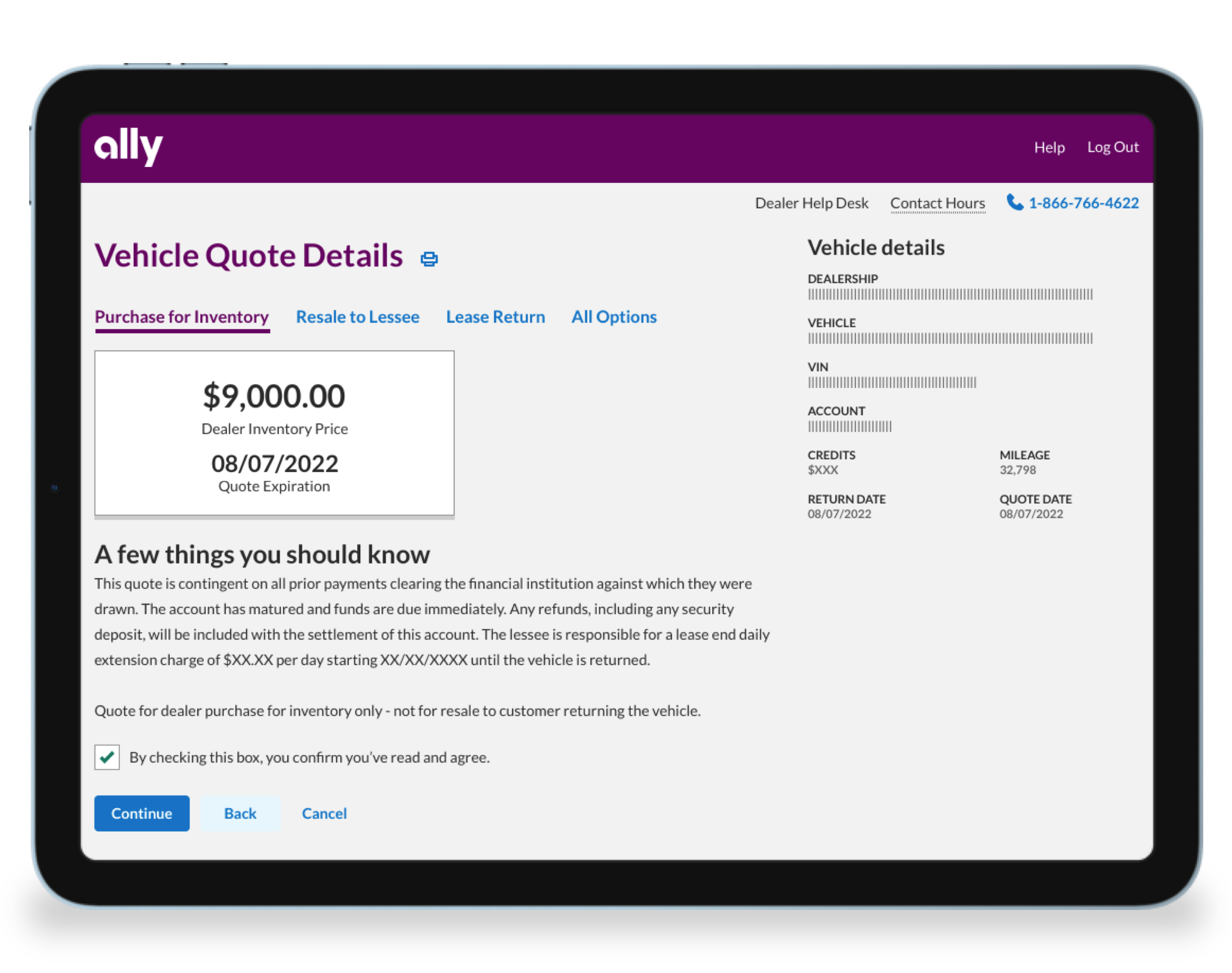

The simplest way to find your payoff address is through your Ally Auto online account. Log in to your account and navigate to the "Payments" or "Payoff" section. Your payoff address should be clearly displayed. This method offers the most up-to-date and accurate information.

- Pros: Quick, easy, and ensures accuracy.

- Cons: Requires access to your online account.

2. Ally Auto Customer Service: A Helpful Alternative

If you're unable to access your online account, contact Ally Auto's customer service department. They'll be able to provide you with the correct payoff address. Be prepared to provide your account information for verification purposes.

- Pros: Helpful for those without online access.

- Cons: May require waiting on hold.

3. Your Loan Documents: A Backup Option

Your original loan documents, such as the promissory note, may contain the payoff address. This is a less reliable method as the address may be outdated, so it should only be used as a last resort.

- Pros: A potential backup if other methods fail.

- Cons: May be outdated and unreliable.

Important Considerations When Paying Off Your Ally Auto Loan

- Verify the Payoff Amount: Before sending your payment, confirm the exact payoff amount with Ally Auto. This prevents any discrepancies and ensures a smooth payoff process. This can also be found within your online account.

- Send Your Payment Early: To avoid any last-minute issues, send your payment well in advance of your desired payoff date. Allow ample time for processing.

- Keep Records: Retain copies of your payment confirmation, including the tracking number if applicable. This documentation provides proof of payment in case of any disputes.

- Choose Your Payment Method Wisely: Ally Auto accepts various payment methods, including electronic transfers, checks, and money orders. Choose the method that works best for your situation. Electronic transfers are often the fastest and most secure.

Conclusion: Achieve Financial Freedom with a Smooth Payoff

Paying off your Ally Auto loan can be a significant step towards achieving your financial goals. By following this simple guide and utilizing the methods outlined above, you can easily find the correct payoff address and ensure a smooth and timely payoff process. Remember to always prioritize accuracy and documentation to avoid potential issues. Now go ahead and enjoy the financial freedom that comes with a paid-off car!