Fifth Third Bank 6-Month CD Rates: Current Yields & How to Compare

Are you considering a 6-month Certificate of Deposit (CD) to boost your savings? Fifth Third Bank is a popular choice, but understanding their current rates and how they compare to other banks is crucial before committing your money. This article will provide you with the latest information on Fifth Third Bank's 6-month CD rates, offer tips on comparison shopping, and help you make an informed decision.

Understanding Fifth Third Bank 6-Month CD Rates

Fifth Third Bank's CD rates, like those of other banks, fluctuate based on various economic factors. Currently, you'll need to visit their website or contact a branch directly to obtain the most up-to-date rates. Their rates are typically competitive within the market, but remember that these rates can change daily. Don't rely on outdated information; always check the official source before making a decision.

Factors Affecting Fifth Third Bank's CD Rates:

Several key factors influence the interest rates offered on Fifth Third Bank's 6-month CDs:

- Current Market Conditions: Interest rate hikes by the Federal Reserve directly impact what banks can offer on their CDs. Higher rates generally mean higher CD yields.

- Your Account Balance: Some banks offer tiered rates, meaning higher balances may qualify for slightly better interest rates. Check with Fifth Third Bank to see if they offer tiered rates on their 6-month CDs.

- Special Promotions: Fifth Third Bank occasionally offers special promotions that might provide a higher interest rate on their CDs for a limited time. Keep an eye out for these opportunities.

How to Compare Fifth Third Bank's CD Rates to Other Banks:

Comparing CD rates is essential to ensure you're getting the best possible return on your investment. Here's a step-by-step guide:

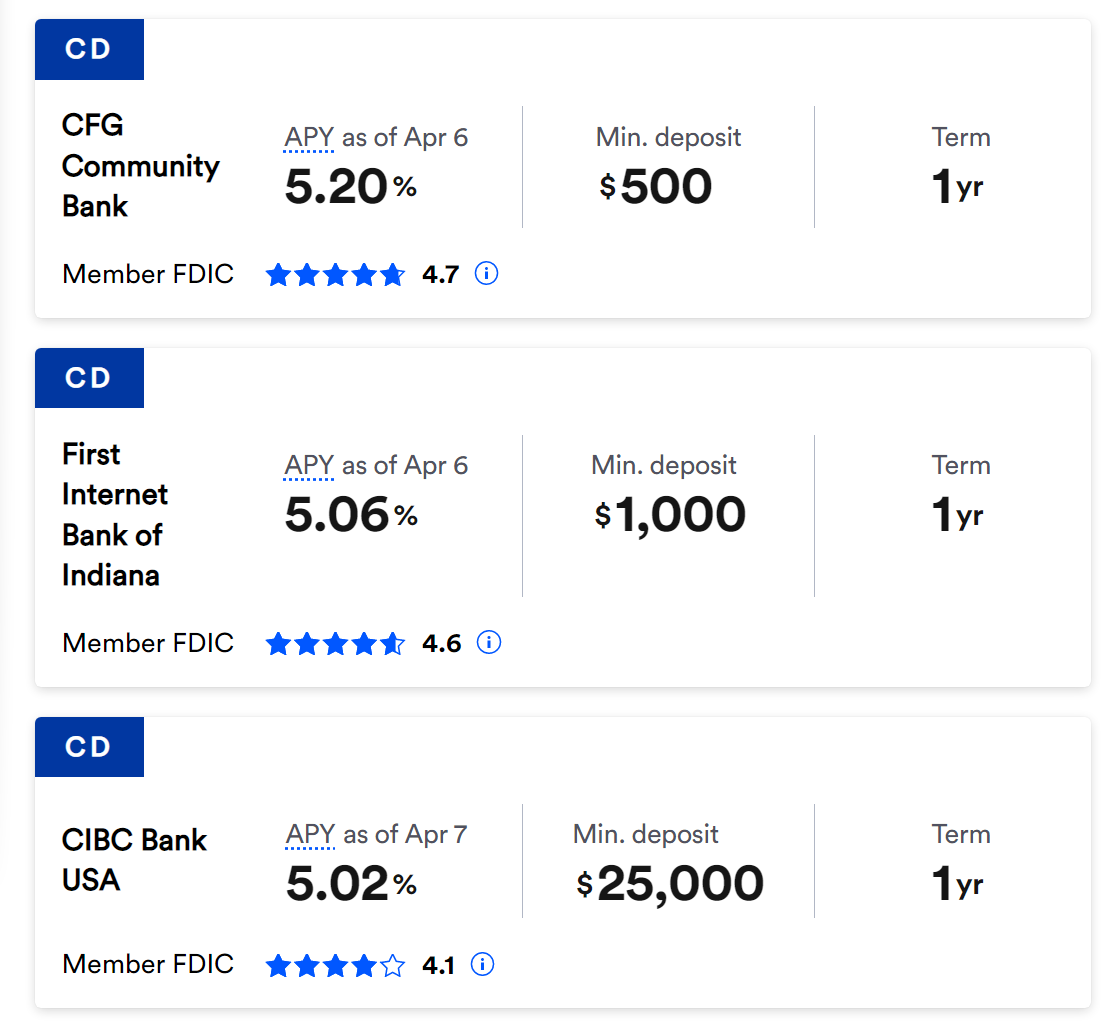

- Check Multiple Banks: Don't limit yourself to Fifth Third Bank. Explore other reputable banks and credit unions in your area, as well as online banks offering potentially higher rates.

- Consider the APY (Annual Percentage Yield): The APY represents the annual rate of return, considering the effect of compounding interest. Always compare APYs, not just nominal interest rates.

- Read the Fine Print: Pay close attention to any fees, penalties for early withdrawal, and the terms and conditions of the CD. These details can significantly impact your overall returns.

- Use Online Comparison Tools: Numerous websites offer tools that compare CD rates from various banks, streamlining the research process.

Tips for Maximizing Your Returns:

- Ladder Your CDs: Consider spreading your investment across CDs with different maturity dates (e.g., 6-month, 12-month, 18-month) to manage risk and potentially benefit from rising interest rates.

- Negotiate: While less common with CDs, you might be able to negotiate a slightly higher rate, particularly if you have a substantial amount to deposit.

Beyond the Numbers: The Importance of Banking Relationship

While maximizing your interest rate is important, also consider the overall banking experience. Do you value the convenience of local branches? Are you comfortable with Fifth Third Bank's online and mobile banking features? A strong banking relationship can offer benefits that go beyond just the interest rate on your CD.

Call to Action:

Before making a decision on your 6-month CD, take the time to compare Fifth Third Bank's current rates with other institutions. Remember to factor in the overall banking relationship and carefully review the terms and conditions. Start your comparison shopping today and secure the best possible return on your savings.

(Disclaimer: This article provides general information and should not be considered financial advice. Always consult with a financial advisor before making any investment decisions. Interest rates are subject to change.)