Fairfax County VA Property Tax Records: Your Complete Guide

Finding and understanding Fairfax County property tax records can feel like navigating a maze. But don't worry! This comprehensive guide will walk you through everything you need to know, from accessing records online to understanding your tax bill and appealing assessments. Whether you're a homeowner, a potential buyer, or simply curious about property values in Fairfax County, Virginia, this resource is for you.

Why are Fairfax County Property Tax Records Important?

Fairfax County property tax records are crucial for a variety of reasons:

- Understanding your property tax liability: This is the most obvious reason. Knowing your assessed value directly impacts how much property tax you owe.

- Real estate transactions: Buyers and sellers rely on these records to determine fair market value and negotiate prices.

- Property assessment appeals: If you believe your property's assessed value is inaccurate, these records are essential for building a case for an appeal.

- Neighborhood research: Examining property records can help you understand trends in property values and taxes within a specific neighborhood.

- Investment analysis: Investors use this data to assess the potential return on investment for properties in Fairfax County.

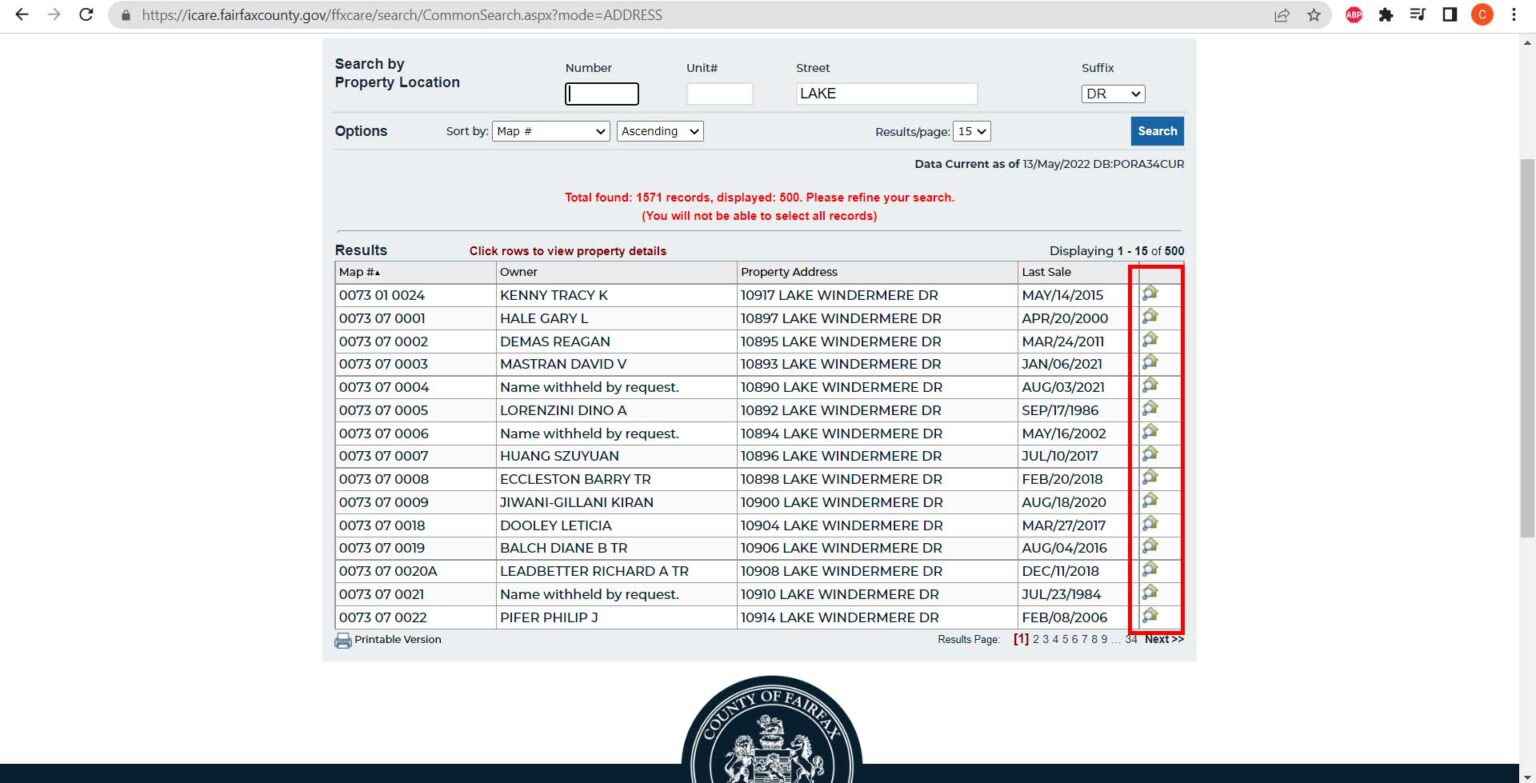

Accessing Fairfax County Property Tax Records Online:

The easiest way to access Fairfax County property tax records is through the Fairfax County Real Estate Assessment Office website. You'll typically find a search function allowing you to search by address, owner name, or parcel ID. The website usually offers:

- Assessed value: The value placed on your property by the county for tax purposes.

- Tax rate: The rate at which your property is taxed.

- Tax bill: Your complete tax bill, including all applicable fees and charges.

- Property details: Information about the property's size, features, and improvements.

- Sale history: A record of past sales for the property.

- Maps and imagery: Aerial photographs and maps of the property.

Understanding Your Fairfax County Property Tax Bill:

Your Fairfax County property tax bill will detail several key components:

- Taxable assessed value: The value subject to taxation.

- Tax rate: The rate applied to the assessed value.

- Tax amount: The total amount of property tax due.

- Due dates: Important dates for paying your taxes to avoid penalties.

- Payment options: Methods available for paying your property taxes (online, mail, in person).

Appealing Your Property Tax Assessment:

If you believe your property's assessed value is too high, you have the right to appeal. The Fairfax County Real Estate Assessment Office provides a detailed process for filing an appeal. Be prepared to provide evidence to support your claim, such as comparable property sales or documentation of property defects. It's crucial to understand the deadlines and requirements for filing an appeal.

Tips for Navigating Fairfax County Property Tax Records:

- Start with the official website: Always use the official Fairfax County Real Estate Assessment Office website for the most accurate and up-to-date information.

- Use precise search terms: When searching for a property, be as specific as possible with the address or owner's name.

- Understand the terminology: Familiarize yourself with common real estate and tax terminology.

- Don't hesitate to ask for help: If you're having trouble navigating the website or understanding your tax bill, contact the Fairfax County Real Estate Assessment Office directly for assistance.

Conclusion:

Understanding Fairfax County property tax records is vital for homeowners, potential buyers, and investors alike. By utilizing the resources provided by the Fairfax County Real Estate Assessment Office and following the steps outlined in this guide, you can confidently navigate the process and manage your property tax obligations effectively. Remember to always check the official website for the most current information and deadlines.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Always consult with a qualified professional for personalized guidance.