Deloitte W2: A Former Employee's Guide to Understanding Your Tax Documents

Navigating the post-employment paperwork can be daunting, especially when it comes to understanding tax documents like your W2. This guide specifically addresses Deloitte W2 forms for former employees, breaking down the key information and helping you prepare for tax season. Whether you're a seasoned tax pro or a first-timer, this comprehensive guide will equip you with the knowledge you need.

What is a W2 Form?

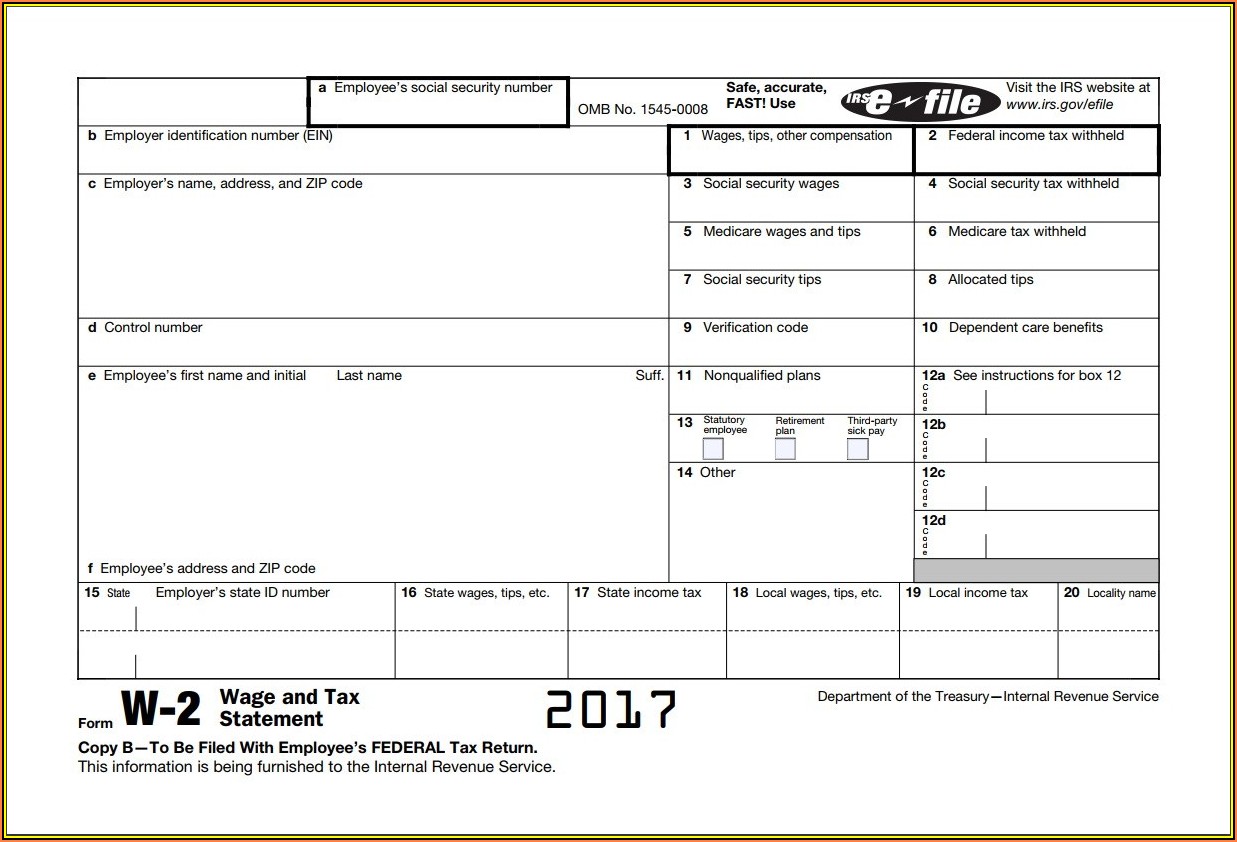

A W2 form, officially titled "Wage and Tax Statement," is a crucial document provided by your employer (in this case, Deloitte) reporting your earnings and the taxes withheld during the previous tax year. It's essential for filing your income tax return. The IRS requires all employers to provide this form by January 31st of the following year.

Key Information on Your Deloitte W2:

Your Deloitte W2 will contain several key sections. Understanding each is critical for accurate tax filing:

-

Employer Information: This section identifies Deloitte as your former employer, including their federal tax identification number (TIN) and address. Double-check this information for accuracy. Any discrepancies could cause delays in processing your return.

-

Employee Information: This section contains your personal information, including your social security number (SSN) and address. Verify this information meticulously against your personal records.

-

Wages: This is arguably the most important section. It outlines your total wages, tips, and other compensation received during the tax year. This includes your base salary, bonuses, and any other taxable income reported by Deloitte.

-

Tax Withholding: This section details the amount of federal, state (if applicable), and local income taxes withheld from your paycheck throughout the year by Deloitte. This amount will be subtracted from your total tax liability during filing.

-

Box 12: Other Compensation: This box may contain various additional payments, such as reimbursements, stock options, or other non-wage compensation. Each code will specify the type of income it represents. Understanding these codes is crucial for accurate reporting.

Common Deloitte W2 Questions:

-

What if I didn't receive my W2 from Deloitte? Contact Deloitte's payroll department immediately. They can provide you with a replacement W2.

-

What if there are errors on my Deloitte W2? Contact Deloitte's payroll department as soon as possible to correct the errors. Obtain a corrected W2 from them before filing your taxes.

-

How do I use my Deloitte W2 to file my taxes? Use the information from your W2 to complete your tax return. Many tax software programs and online services can guide you through the process. Consider consulting a tax professional for personalized assistance.

Additional Resources:

-

IRS Website: The official IRS website offers comprehensive information on W2 forms and tax filing.

-

Deloitte's Employee Resources: Check Deloitte's internal website for employee resources and FAQs related to tax documents.

Next Steps:

Once you receive your Deloitte W2, review it carefully. If you have any questions or concerns, don't hesitate to contact Deloitte's payroll department or seek assistance from a tax professional. Accurate and timely tax filing is crucial to avoid penalties and ensure a smooth tax season. Remember to file your taxes by the designated deadline!

This article provides a helpful overview, but it's not a substitute for professional tax advice. Always consult with a qualified tax advisor for personalized guidance.