Cramer Charitable Trust Holdings: A Deep Dive Podcast Analysis

Introduction: Jim Cramer, the outspoken host of CNBC's "Mad Money," is known for his volatile investment advice. But what about his own investments? This article dives into a recent podcast analysis of the Cramer Charitable Trust holdings, revealing insights into his investment strategy and offering valuable takeaways for individual investors. We'll explore the portfolio's composition, its performance, and what it might suggest about Cramer's actual approach to the market, contrasting it with his often-dramatic on-air persona.

The Podcast: Unpacking the Data: Several finance podcasts have recently dedicated episodes to analyzing the publicly available holdings of the Cramer Charitable Trust. These analyses offer a rare glimpse behind the curtain, allowing us to assess Cramer's investment choices independent of his television persona. The podcasts typically utilize SEC filings and other public data to dissect the portfolio's allocation across different sectors, asset classes, and individual stocks. This allows for a detailed understanding of his risk tolerance and long-term investment strategy.

Key Findings from Podcast Analyses:

- Sector Diversification: Podcasts consistently highlight a relatively diversified portfolio, although with a clear bias towards certain sectors. The specific sectors vary depending on the year and market conditions analyzed in the podcast. Analyzing this diversification strategy allows investors to understand how to mitigate risk in their own portfolios.

- Large-Cap Focus: The Cramer Charitable Trust often shows a preference for established, large-cap companies. Podcasts usually discuss the implications of this approach, contrasting it with potential gains from investing in smaller, more volatile companies.

- Technology Sector Weighting: Many podcasts point out a significant weighting towards the technology sector, reflecting the growth potential Cramer sees in this area. Understanding this sector weighting helps investors consider its role in their own investment strategy.

- Active vs. Passive Management: The discussions within the podcasts often debate whether the Cramer Charitable Trust reflects an active or passive investment management approach. This distinction is vital for individual investors considering their own investment styles.

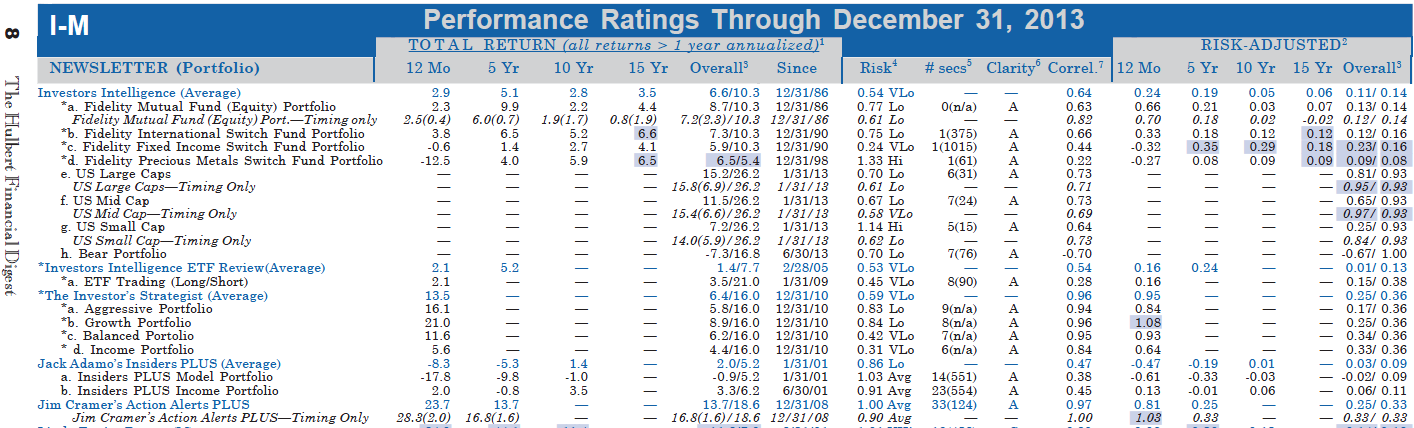

- Performance Analysis: A crucial aspect of the podcast analyses is the evaluation of the Trust's performance against market benchmarks. This provides insights into whether Cramer's strategy is actually outperforming the market or merely keeping pace.

Contrasting On-Air Persona with Actual Investments:

One of the most intriguing aspects discussed in these podcast analyses is the contrast between Cramer's boisterous on-air style and the more conservative, diversified nature of his charitable trust's investments. This highlights the importance of separating media personality from actual investment decisions. Podcasts often use this contrast to emphasize the need for independent research and careful consideration of investment strategies.

Lessons for Individual Investors:

While mimicking Cramer's exact portfolio might not be feasible or advisable for all investors, these podcast analyses offer several valuable lessons:

- Importance of Diversification: The Cramer Charitable Trust demonstrates the benefits of diversification across sectors and asset classes.

- Long-Term Perspective: Investing in established companies suggests a long-term investment horizon.

- Independent Research: The analysis emphasizes the importance of conducting your own due diligence before making any investment decisions.

- Separate Media Hype from Investment Strategies: Podcasts underscore the need to critically evaluate investment advice from any source.

Conclusion:

Podcasts offering deep dives into the Cramer Charitable Trust holdings provide a unique opportunity to learn from the investment decisions of a well-known figure. By analyzing the portfolio's composition, performance, and risk profile, individual investors can gain valuable insights and refine their own investment strategies. Remember to always conduct thorough research and consider your own risk tolerance before making any investment decisions. Listen to these podcasts and make informed choices about your own financial future!

Call to Action: Search for podcasts discussing the Cramer Charitable Trust holdings and broaden your investment knowledge. What are your thoughts on Cramer's investment strategy? Share your insights in the comments below!