Comenity Net MyCash Mastercard: A Complete Guide

The Comenity Net MyCash Mastercard is a popular store credit card offering a variety of perks and benefits. But is it right for you? This comprehensive guide dives deep into the features, benefits, drawbacks, and everything you need to know before applying. We’ll explore its interest rates, rewards programs, application process, and more to help you make an informed decision.

What is the Comenity Net MyCash Mastercard?

The Comenity Net MyCash Mastercard is a store-branded credit card issued by Comenity Capital Bank. It's designed to offer convenient financing options for purchases made at participating retail stores. While it might not be accepted everywhere like a major credit card, its benefits often focus on special promotions and exclusive offers within its partnered merchant network. Think of it as a specialized card tailored for specific shopping habits.

Key Features and Benefits:

-

Special Financing Offers: This is often the biggest draw. Many Comenity Net MyCash cards offer promotional financing periods, allowing you to spread the cost of purchases over several months with reduced or zero interest. Always read the terms carefully though, as failing to pay the balance in full before the promotional period ends will result in accruing high interest charges.

-

Rewards Programs (Potential): While not all Comenity Net MyCash cards offer rewards, some might provide cashback or points on purchases made at specific stores. This varies greatly depending on the specific card and the merchant partnership. Always check the terms and conditions of your specific card.

-

Simple Application Process: Applying for the Comenity Net MyCash Mastercard is generally straightforward and can often be done online. You will need to provide personal and financial information.

-

Credit Building Potential: Responsible use of a credit card, like paying your balance on time and in full, can help build your credit score. This is true for the Comenity Net MyCash Mastercard as well.

Drawbacks to Consider:

-

Limited Acceptance: Unlike Visa or Mastercard, this card's acceptance is typically limited to the specific stores partnered with Comenity Bank. Don't expect to use it widely.

-

High Interest Rates: If you don't pay your balance in full before the promotional period (if any), the interest rates can be quite high, potentially leading to significant debt.

-

Potential for Fees: Be aware of potential fees such as late payment fees, annual fees (though often waived), and foreign transaction fees.

-

Store-Specific Rewards: While rewards are enticing, they are usually limited to the participating stores, which may not align with your regular spending habits.

How to Apply for the Comenity Net MyCash Mastercard:

The application process is usually done online through the Comenity Bank website or at a participating store. You will typically need to provide:

- Personal Information: Name, address, date of birth, Social Security number.

- Financial Information: Income, employment history, existing credit accounts.

Managing Your Comenity Net MyCash Mastercard:

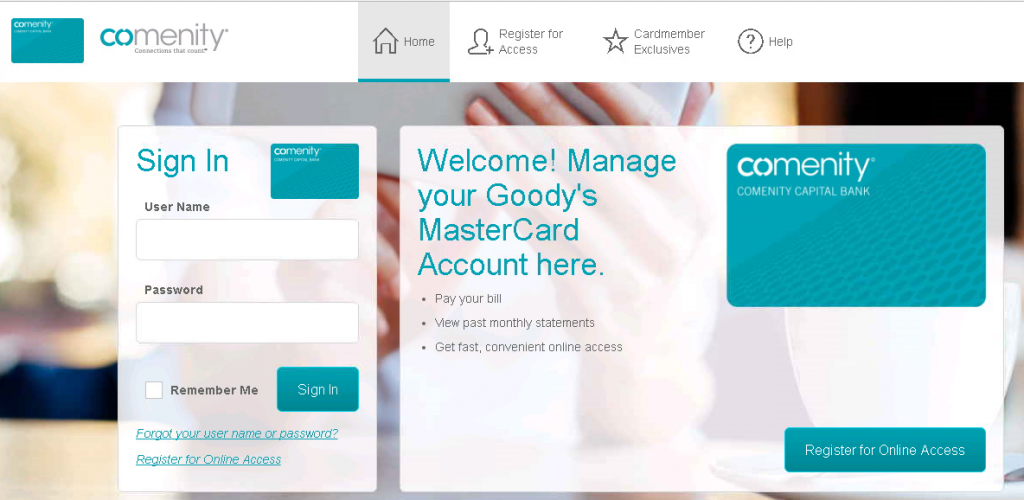

- Online Account Access: Comenity Bank provides online account access for easy balance tracking, payment management, and statement viewing.

- On-Time Payments: Prioritize on-time payments to avoid late fees and maintain a good credit score.

- Budgeting: Carefully budget your spending to avoid accumulating debt.

Alternatives to the Comenity Net MyCash Mastercard:

If the limitations of a store-branded credit card don't suit your needs, consider exploring general-purpose credit cards such as those offered by major banks or credit unions. These typically provide wider acceptance and a broader range of rewards programs.

Conclusion:

The Comenity Net MyCash Mastercard can be a useful tool for managing purchases at specific stores, especially when promotional financing is offered. However, it's crucial to understand its limitations, including limited acceptance and potentially high interest rates. Carefully weigh the pros and cons and ensure it aligns with your financial goals before applying. Always read the fine print and understand the terms and conditions before committing to any credit card agreement.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Always consult with a financial professional before making any financial decisions.