Best Fidelity Index Funds for Your Investment Portfolio: A Comprehensive Guide

Are you looking to diversify your investment portfolio with low-cost, broadly diversified index funds? Fidelity Investments offers a robust selection, making it a popular choice for both beginners and seasoned investors. This comprehensive guide explores some of the best Fidelity index funds, helping you choose the options that align with your investment goals and risk tolerance.

Why Choose Fidelity Index Funds?

Fidelity boasts a reputation for offering low expense ratios, a wide range of index funds tracking various market segments, and a user-friendly investment platform. Their index funds provide broad market exposure, minimizing the risk associated with individual stock picking. This makes them an excellent choice for long-term investors seeking consistent growth.

Top Fidelity Index Funds to Consider:

Choosing the right fund depends on your investment timeline, risk tolerance, and specific market exposure you desire. Here are some of the top contenders:

1. Fidelity ZERO™ Total Market Index Fund (FZROX):

- Focus: Tracks the total US stock market, offering broad diversification across large, mid, and small-cap companies.

- Expense Ratio: 0% – a significant advantage, minimizing your costs over time.

- Ideal For: Beginners and those seeking broad US market exposure with minimal fees. This is a fantastic core holding for any portfolio.

2. Fidelity ZERO™ International Index Fund (FZILX):

- Focus: Tracks a broad range of international stocks, excluding the US.

- Expense Ratio: 0% – again, a major advantage for international diversification.

- Ideal For: Investors seeking global diversification and exposure to international market growth.

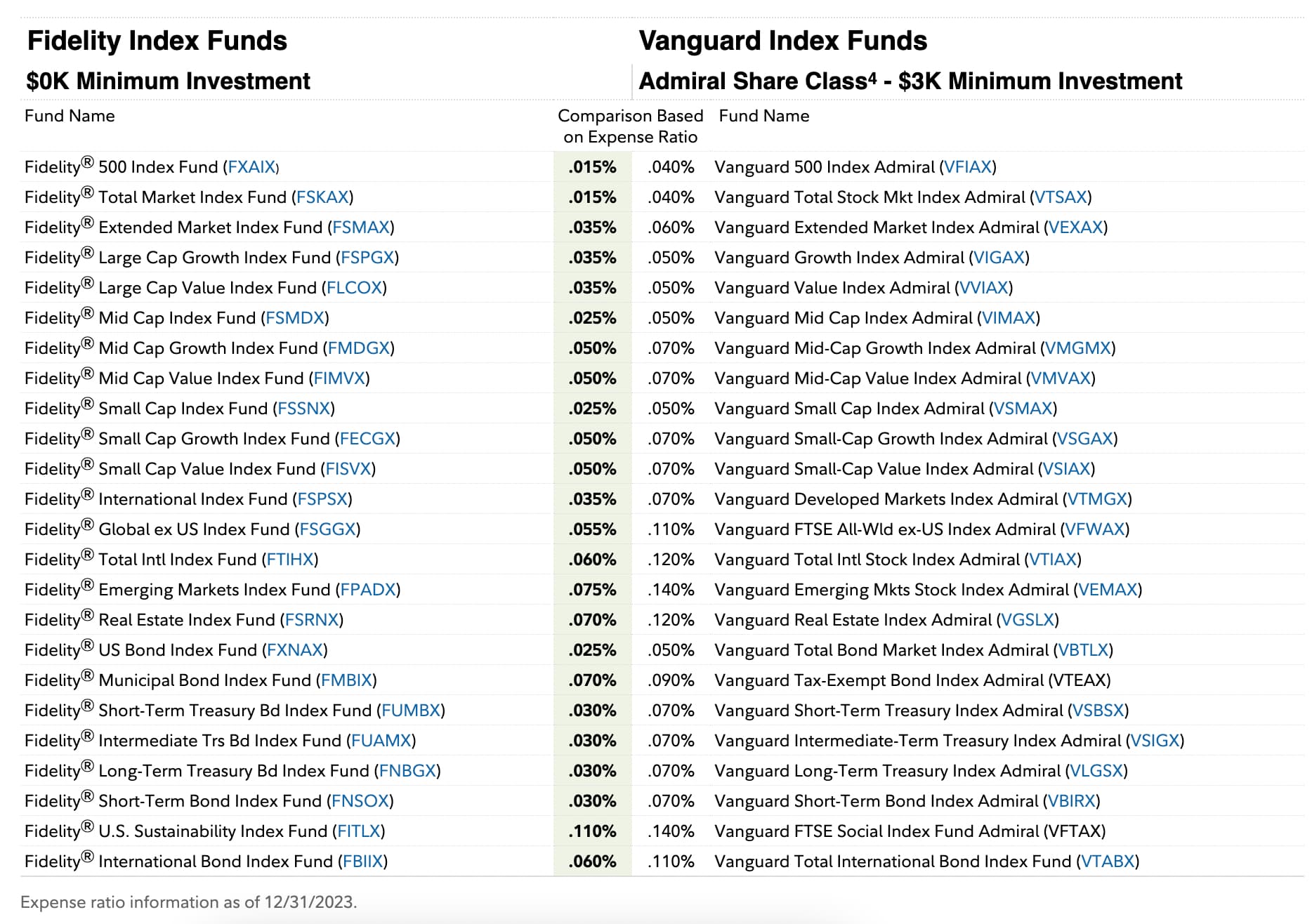

3. Fidelity 500 Index Fund (FXAIX):

- Focus: Tracks the S&P 500 index, comprising 500 of the largest publicly traded US companies.

- Expense Ratio: Low, but slightly higher than the ZERO™ funds.

- Ideal For: Investors focused on large-cap US companies and seeking a more established, historically high-performing index.

4. Fidelity Total Bond Market Index Fund (FTBFX):

- Focus: Provides exposure to a broad range of investment-grade US bonds.

- Expense Ratio: Low and competitive within the bond market index fund category.

- Ideal For: Investors seeking diversification beyond stocks and a lower-risk, income-generating component to their portfolio.

Building Your Portfolio with Fidelity Index Funds:

A well-diversified portfolio often incorporates a mix of stock and bond index funds. A simple strategy might involve combining FZROX (or FXAIX) and FZILX for broad stock market coverage and FTBFX for bond market exposure. The specific allocation will depend on your individual risk tolerance and investment goals. Remember to consult with a financial advisor to determine the best allocation for your circumstances.

Factors to Consider When Choosing:

- Expense Ratio: A lower expense ratio means more of your money works towards growth.

- Investment Objective: Align your fund selection with your long-term goals (retirement, education, etc.).

- Risk Tolerance: Consider your comfort level with market fluctuations. Bond funds generally offer lower risk than stock funds.

- Diversification: Spreading your investments across different asset classes reduces overall portfolio risk.

Beyond the Funds:

While these funds are excellent choices, remember to research and understand your investment options thoroughly. Fidelity provides extensive resources and tools on their website to assist you. Consider using their investment planning tools and consulting with a financial advisor to create a personalized investment strategy.

Call to Action:

Ready to start building your diversified portfolio? Explore Fidelity's range of index funds today and take the first step towards achieving your financial goals. [Link to Fidelity Website] Remember to consult with a financial professional before making any significant investment decisions.