100 Cash App Payments: A Comprehensive Guide

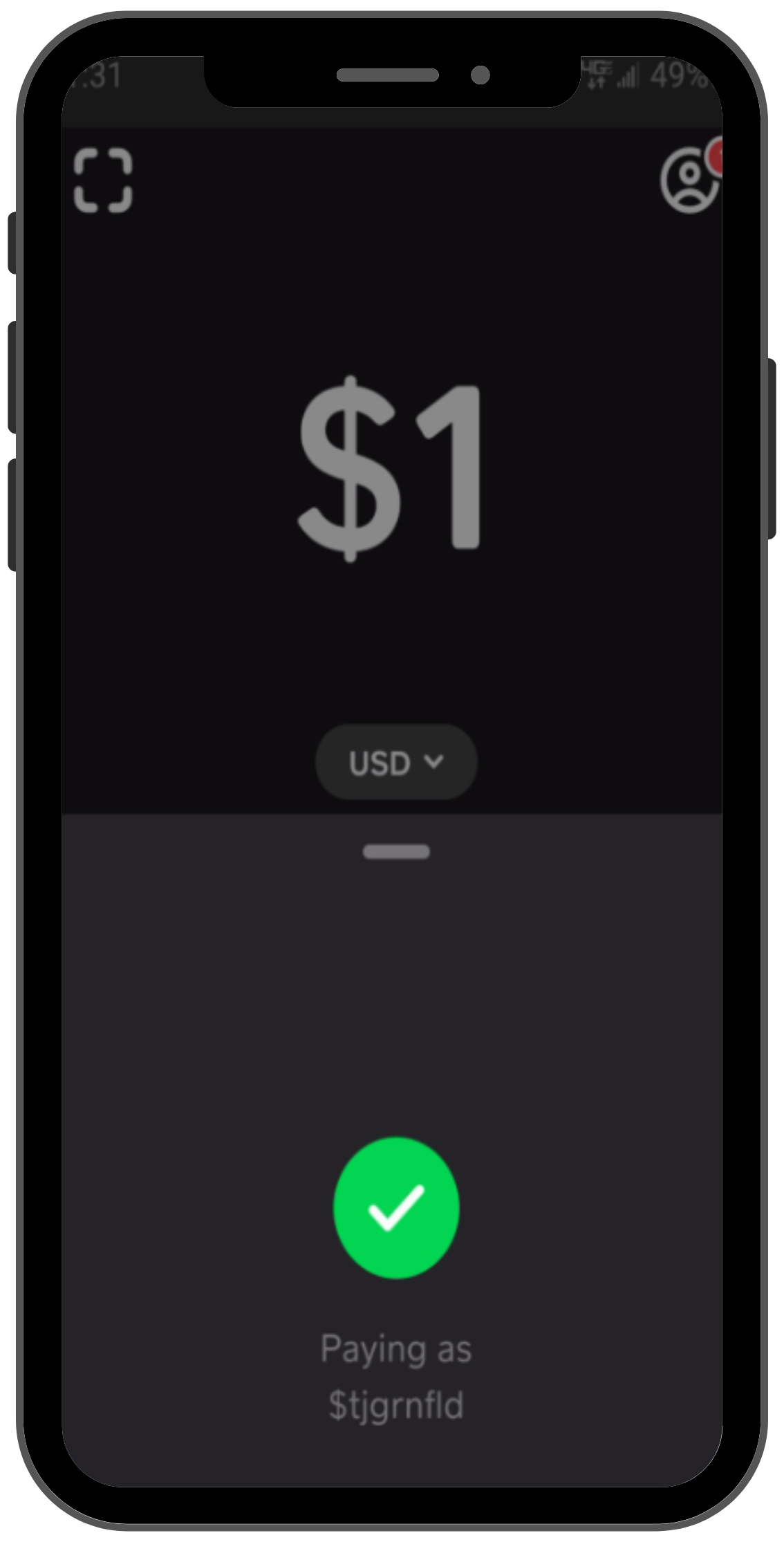

Sending or receiving 100 Cash App payments might sound like a lot, but it's becoming increasingly common for various reasons. Whether you're a small business owner managing numerous transactions, a freelancer handling client payments, or simply curious about the possibilities, understanding how to navigate 100 Cash App payments efficiently is key. This comprehensive guide will walk you through everything you need to know.

Understanding Cash App Payment Limits

Before diving into managing 100 payments, it's crucial to understand Cash App's limitations. Cash App imposes daily and weekly sending limits, which vary depending on several factors including your verification status and payment history. Reaching these limits can temporarily restrict your ability to send or receive funds. Regularly exceeding these limits could even lead to your account being flagged for review. Always check your account's specific limits to avoid any disruptions.

- Verification: A fully verified Cash App account generally offers higher payment limits.

- Payment History: Consistent, legitimate transactions contribute to a positive payment history and higher limits.

- Account Age: Newer accounts typically have lower limits than established accounts.

Managing 100 Cash App Payments: Strategies and Tips

Handling a large volume of Cash App payments requires organization and strategy. Here are some effective approaches:

- Spreadsheet Tracking: Maintain a detailed spreadsheet documenting each payment – including the date, recipient, amount, and purpose. This provides an auditable trail for your records.

- Categorization: Categorize your payments for easier analysis and tax reporting. For businesses, separate payments by client, product, or service.

- Automated Reminders: If you're expecting numerous payments, set up automated reminders for both yourself and your clients.

- Batch Processing: When possible, batch process payments to streamline the process.

- Regular Account Monitoring: Regularly check your Cash App account for any unusual activity or potential issues. This proactive approach can help identify and address problems early.

- Security Measures: Utilize strong passwords, enable two-factor authentication, and be vigilant about phishing scams to protect your account and funds.

Common Scenarios for High-Volume Cash App Payments

Several situations may involve a large number of Cash App transactions:

- Small Business Operations: Many small businesses rely on Cash App for quick and convenient transactions with customers.

- Freelancers and Gig Workers: Freelancers often receive payments from multiple clients via Cash App.

- Group Contributions: Pooling money for events, gifts, or shared expenses can involve many individual payments.

- Peer-to-Peer Lending: While not recommended without careful consideration, some individuals utilize Cash App for informal lending arrangements.

Potential Challenges and Solutions

While Cash App offers convenience, managing a high volume of payments can present challenges:

- Payment Processing Fees: Be aware of potential processing fees, especially for larger transactions.

- Chargebacks and Disputes: Understand Cash App's dispute resolution process in case of payment issues.

- Account Limitations: Always stay within Cash App's payment limits to avoid account restrictions.

Conclusion: Efficiently Handling 100 Cash App Payments

Successfully managing 100 Cash App payments requires planning, organization, and awareness of the platform's limitations. By employing the strategies outlined above and staying informed about Cash App's policies, you can efficiently handle large payment volumes while minimizing potential issues. Remember to prioritize security and maintain accurate records for smooth financial management.

Further Reading:

-

- For detailed information on payment limits, security, and troubleshooting.

-

- For more advice on managing finances for small businesses.

Call to Action: Have you experienced managing a high volume of Cash App payments? Share your tips and experiences in the comments below!